by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Europol Dismantles Massive Illegal IPTV Network in Operation Kratos

Europol, in partnership with authorities from multiple countries and organizations, recently concluded Operation Kratos, aimed at dismantling one of the largest illegal streaming services operating through IPTV networks. This successful operation resulted in the arrest of several suspects and the disruption of an illicit network with a staggering 22 million customers spanning various countries worldwide.

LALIGA and International Cooperation

LALIGA, the premier Spanish football league, played a significant role in supporting the investigation. The collaborative operation, spearheaded by Europol, involved over 15 countries, including Bulgaria, Italy, Croatia, France, Germany, the Netherlands, and the UK. In addition to law enforcement agencies, private entities like UEFA, AAPA, and MPA provided crucial support in identifying and shutting down illegal streaming platforms.

The investigation officially began in June 2024 and continued through September of that year, a period that coincided with major events like the Summer Olympics and Euro 2024, which saw spikes in illegal streaming activity. Coordinated by Bulgaria’s DGCOP (Ministry of the Interior), this unprecedented action was executed under the framework of the European Commission’s EMPACT platform, which prioritizes combating intellectual property crimes.

The Scope of Illegal Operations

Authorities uncovered an extensive illegal IPTV network that distributed over 2,500 TV channels, films, sports content, and series without authorization. This criminal enterprise operated through numerous platforms, benefiting an expansive user base. In total, investigators identified 102 suspects, 11 of whom were arrested, with a larger group of 560 dealers connected to the piracy ecosystem.

During the operation, over 112 searches were conducted, resulting in the seizure of significant assets tied to the illegal activities. These included 29 servers, 270 IPTV devices, and 100 domains, along with approximately €40,000 in cash and €1.6 million (around R$10 million) in cryptocurrencies. In addition, firearms and narcotics were also confiscated, reflecting the broader scope of this criminal network.

The Global Fight Against Streaming Piracy

The scale of Operation Kratos highlights the necessity of cross-border cooperation to combat intellectual property violations effectively. Participating countries, including Spain, Romania, Greece, Latvia, and North Macedonia, played integral roles in these investigations. Private organizations provided legal and technical expertise to identify, document, and disable illegal streaming sources.

These efforts emphasize the growing importance of protecting copyrighted material in the digital era and send a strong message to those engaged in piracy. The operation marks a robust stride against the unauthorized distribution of content, particularly sports and entertainment media, underscoring the commitment of both public and private sectors to safeguarding intellectual property globally.

This coordinated effort represents a significant milestone in curbing illegal streaming services, ensuring sports leagues, broadcasters, and other content creators are adequately protected against financial and reputational losses caused by piracy.

Conclusion

Europol’s Operation Kratos, with support from law enforcement agencies, private organizations, and governments, successfully dismantled this large-scale IPTV piracy operation. Beyond arrests and asset seizures, the operation underscores the importance of global collaboration in tackling intellectual property violations. It serves as a stark warning to individuals and groups engaging in similar criminal activities while paving the way for future efforts to combat illegal content distribution.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

What is an AI Agent? Exploring Its Role in Technology and Investment Trends

An AI agent refers to advanced artificial intelligence that autonomously and efficiently handles complex tasks without human intervention. The rapid growth of AI technology has captured the interest of major industries, including the stock market and venture capital sectors.

In the stock market, semiconductors—essential for AI development and machine learning systems—are receiving increased attention. This trend is being led by companies like Nvidia in the United States, which plays a dominant role in powering AI systems through its cutting-edge products.

In the startup ecosystem, AI-related innovation has been a magnet for investment. From 2019 to 2024 alone, venture capital firms have poured a staggering $290 billion into AI-focused startups, showcasing the immense confidence investors have in this field’s potential.

Simultaneously, blockchain technology has emerged as a key area of exploration for enhancing AI capabilities. Many experts believe blockchain has the potential to revolutionize AI agent technology by ensuring security, scalability, and efficiency in data processing and task execution. This combination of blockchain and AI could pave the way for groundbreaking advancements across various industries.

The intersection of AI and blockchain represents a promising future involving technologies that not only optimize complex processes but also redefine how tasks are automated and managed in the digital age. As these innovations evolve, they continue to shape the trajectory of global technology and economic landscapes.

Key Takeaways:

- AI agents autonomously perform complex tasks without needing human input.

- Semiconductor-related stocks, especially Nvidia, are gaining attention due to their importance in AI development.

- Venture capital investment in AI startups has reached $290 billion over five years (2019–2024).

- Blockchain has significant potential to enhance AI agent capabilities, offering security and scalability for future advancements in AI technology.

Stay tuned as these transformative technologies continue to reshape industries and drive innovation worldwide.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

FTX Creditor Repayment Plan Goes Live: What You Need to Know

The long-awaited FTX payout plan has officially launched on January 3, 2025. This milestone marks a significant step forward for creditors seeking recovery of their assets following the cryptocurrency exchange’s downfall. Here’s a comprehensive breakdown of what this means for creditors.

Creditor Repayments Timeline

FTX estate representatives have announced that distributions to creditors will commence within 60 days of January 3, 2025. Initial payouts will prioritize the "convenience class"—creditors with approved claims of $50,000 or less. These creditors are expected to receive approximately 119% of the total claim amount, including principal and accrued interest. This round of repayments amounts to nearly $1.2 billion and is slated to be completed by March 2025.

For creditors with claims exceeding $50,000, a larger pool worth $10.5 billion is allocated for later distributions. However, the timeline for this group will extend beyond the initial payout schedule.

Key Payout Details

-

Creditors are required to:

- Complete Know Your Customer (KYC) verification.

- Submit tax forms using the designated Customer Portal.

- Choose a distribution manager—BitGo or Kraken—for the transfer of funds.

-

Distribution will be facilitated by BitGo and Kraken, covering accessible jurisdictions.

- The total value of distributions is estimated to range from $14.7 billion to $16.5 billion, with convenience-class creditors prioritized in the initial phase.

Impact on the Crypto Market

Analysts suggest around $2.4 billion may re-enter the cryptocurrency markets following the implementation of this payout plan. However, certain restrictions might limit the redistribution into crypto assets:

- $3.9 billion in claims were purchased by credit funds, which are unlikely to reinvest in cryptocurrencies.

- About 33% of total claims involve individuals from sanctioned countries, insiders, or those unable to complete KYC procedures, potentially leaving these funds unclaimed.

Next Steps for Creditors

Creditors eligible for payouts must act quickly to meet the requirements outlined by the estate. This includes finalizing their KYC process, submitting the W-8 BEN form (for non-U.S. individuals/entities), and onboarding with their preferred distribution manager.

Significantly, repayments to the $50,000-and-under convenience class are expected to be fully executed within the next 60 days. Meanwhile, other creditors should remain informed about further announcements regarding additional distribution phases.

What’s Next?

The launch of the FTX distribution plan offers a path forward for creditors who have faced significant uncertainty since the exchange’s collapse. It underscores progress in resolving one of crypto’s largest financial disasters, bringing clarity to affected individuals and institutions.

By early 2025, the financial landscape for many FTX creditors may begin to stabilize. However, ongoing participation in the claims process will be critical for ensuring fund recovery.

Takeaway: While the FTX payout plan launch is a step in the right direction, creditors must actively engage in the outlined processes to retrieve their funds. With the window for repayment underway, timely action paired with ongoing updates will be essential for success.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

BlackRock and Frax Finance Introduce frxUSD Stablecoin Backed by Institutional Assets

BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) is making significant strides in the digital asset space. This progress comes with Frax Finance’s approval of BUIDL as collateral for its newly rebranded frxUSD stablecoin, a move announced in January 2024.

What is frxUSD?

frxUSD is Frax Finance’s enhanced stablecoin, offering both direct fiat redemption and regulatory compliance. Frax Finance’s founder, Sam Kazemian, highlighted the innovation behind frxUSD, stating:

“frxUSD combines the transparency and programmability of blockchain technology with the trust and stability of BlackRock’s prime treasury offerings.”

The stablecoin will be backed by assets managed within BlackRock’s BUIDL fund, including cash reserves, U.S. Treasury bills, and repurchase agreements. This partnership aims to seamlessly integrate traditional finance with decentralized financial systems through robust transparency, with all transactions recorded on-chain. The integration also introduces improved fiat on-and-off ramping capabilities, bridging the gap between traditional and crypto ecosystems.

The Role of BUIDL in Digital Assets

BlackRock’s BUIDL fund has emerged as a pioneering leader in tokenized real-world assets, with over $400 million under management. The fund has expanded its reach, moving beyond Ethereum to other major blockchains, including Polygon, Avalanche, Optimism, and Arbitrum. These efforts are part of BlackRock’s strategy to position BUIDL as a versatile and reliable collateral asset within the crypto landscape.

BUIDL also underpins other innovative projects, such as the Ethena USDtb stablecoin, highlighting its growing influence in the decentralized finance (DeFi) ecosystem. Additionally, BlackRock is exploring the use of BUIDL as collateral for derivatives trading on centralized exchanges, further solidifying its role in the evolving digital economy.

Why Tokenized Assets are Gaining Momentum

The appeal of tokenized real-world assets, such as U.S. Treasuries, is rapidly growing within the blockchain ecosystem. Recent data indicates that over $3.5 billion worth of these assets has been tokenized on networks like Ethereum and Solana, reflecting the broader financial sector’s shift towards blockchain-enabled solutions. These tokenized investments offer unprecedented transparency and efficiency, fostering greater trust and accessibility for institutional investors.

Carlos Domingo, CEO of Securitize, summed up the transformative potential of tokenized assets by saying:

“Tokenized real-world assets provide an excellent bridge between traditional finance and decentralized finance, bringing institutional-grade investments on-chain with unprecedented transparency and efficiency.”

A New Era of Finance

BlackRock’s expanding influence in the DeFi space, alongside partnerships with Frax Finance and others, underscores a broader industry trend towards merging traditional financial systems with blockchain technology. As institutional-grade investment options become more accessible through decentralized platforms, the next chapter of financial evolution is unfolding—one that blurs the lines between traditional and decentralized systems while prioritizing transparency, compliance, and efficiency.

This transformation represents a significant step toward mainstream adoption of blockchain-based financial solutions, making 2024 a pivotal year for tokenized assets and innovative stablecoin designs like frxUSD.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

BNB Chain Introduces Exciting New Projects in Gaming, DeFi, AI, and Web3

The BNB Chain continues its impressive growth by unveiling eight innovative projects across gaming, decentralized finance (DeFi), and artificial intelligence (AI). These groundbreaking platforms, launched between December 6th and December 15th, 2025, promise to transform the Web3 ecosystem with unique utilities and futuristic applications.

Gaming Projects Lead the Way

Gaming takes center stage on the BNB Chain, with several intriguing developments:

- Balls: This AI-powered sports gaming platform blends prediction markets, fantasy sports, and skill-based competitions, offering a highly interactive experience for sports enthusiasts.

- Gameland: A decentralized platform designed for Web3 game developers, Gameland fosters game-building innovations for the next wave of blockchain-based experiences.

- Monoland: Inspired by Monopoly, Monoland offers players a digital environment where they can explore, invest, and grow real-world assets in a virtual landscape.

- Pentagon Games: Positioned as a multichain entertainment hub, Pentagon Games delivers secure, AI-driven 3D experiences while helping brands merge seamlessly with Web3 technology.

- Slippery Snek Game: A modern twist on the classic Snake game, this project incorporates Smartlayer’s Tapp technology, offering low gas fees and multiple leaderboards for competitive engagement.

Revolution in DeFi

Decentralized finance continues to thrive on BNB Chain, with new platforms making strides in efficiency and accessibility:

- Coinfair: A next-generation decentralized exchange (DEX) that has already entered its alpha testing phase, offering upgraded trading and liquidity solutions.

- Pinkpunk: A streamlined and user-friendly trading platform providing an effortless buy-and-sell experience.

AI Expands into Web3

AI-driven platforms are playing a crucial role in shaping the future of the BNB Chain:

- OpenTaskAI: This AI-powered talent marketplace connects skilled professionals with opportunities in the fast-evolving tech industry, creating a bridge between AI capabilities and employment prospects.

Advancing the Web3 Ecosystem

These projects not only diversify the offerings on the BNB Chain but also enhance its presence across gaming, finance, and artificial intelligence. As they continue to grow and innovate, they are set to drive significant contributions to the Web3 space, fostering adoption and maturity in the blockchain ecosystem.

With such diverse advancements, the BNB Chain establishes itself as a hub for groundbreaking blockchain developments. As these projects evolve, they are expected to bring significant value and further solidify the chain’s leadership in the Web3 economy.

Image Credit: Shutterstock

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Meet Christian: The Crypto Crusader, Gearhead, and Feline Philosopher

They say journalists never truly clock out – and for Christian, that’s not just a saying, it’s a way of life. By day, he deciphers the ever-changing tides of the cryptocurrency market, cutting through complex jargon to empower readers with knowledge. But when his computer screen goes dark, Christian shifts gears – sometimes quite literally – into his passions for motorbikes, philosophy, and the good company of his furry companions.

From Feature Writer to Crypto Enthusiast

Christian’s love for storytelling started long before the digital currency revolution. Back in college, his days revolved around feature writing for his school paper. His passion for crafting compelling stories primed him for success, leading to a role as an editor at a data engineering firm, where his first-month essay win stocked up months’ worth of treats for his beloved pets.

His journalism career then took him around the globe. From working with newspapers in Canada and South Korea to a decade-long stint with a prominent news outlet in the Philippines, Christian became a bona fide news junkie. But it wasn’t long before a new fascination caught his eye – cryptocurrency.

The crypto world, with its treasure-hunt-like allure and endless stories waiting to be told, pulled him in. This perfect blend of intrigue and narrative became his niche. Today, he is a trusted crypto journalist, adept at simplifying complex blockchain concepts for everyday readers. He credits his management team for sharpening his ability to break down complicated topics into digestible insights.

Off the Clock: Life Beyond the Digital World

It’s not all work for Christian, though! When he’s not diving into the world of Bitcoin and blockchain, you’ll likely find him indulging his geeky side as a motorbike enthusiast. A proud owner of a Yamaha R3, he has a love for tinkering with his bike and exploring the open road. Once a daredevil who clocked 120 mph (a record he vows never to repeat), Christian now opts for calmer, scenic rides along coastal roads, letting the wind brush against what he humorously calls his “thinning hair.”

Back home, his loyal squad awaits – two cats and a dog. Christian’s an unapologetic cat fan, believing they’re “way smarter” than dogs (don’t worry, Grizzly, you’re still loved). Watching his pets lounging around gives him surprising bursts of inspiration to create finely tuned articles.

Fueled by Food, Coffee, and the Love of Clean Copy

Christian’s work ethic is powered by an endless stream of coffee and mouthwatering Filipino food. For him, a great meal isn’t just nourishment – it’s the secret sauce to crafting stellar articles. And after a long day of chasing crypto trends, he winds down with his signature drink – an unconventional but oddly satisfying mix of rum and milk – while enjoying slapstick comedy classics.

Looking Ahead

As a passionate crypto journalist, Christian sees an exciting future ahead. Being part of an organization that values expertise and innovation fuels his drive to deliver impactful stories. He calls himself privileged to work alongside people he admires and respects while contributing to a growing community of crypto enthusiasts.

So, next time you’re navigating the world of cryptocurrency, keep an eye out for Christian’s work. Behind every expertly crafted article is a journalist, biker, and animal lover with an insatiable curiosity for new trends and timeless tales.

This revised version maintains a clear, engaging tone, enhances SEO-friendliness by focusing on relevant keywords (crypto journalist, cryptocurrency storytelling, motorbike enthusiast, Filipino food, etc.), and improves readability with structured paragraphs and subheadings.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Grayscale Adds 6 New High-Upside Tokens to Its 2025 List

Leading asset manager Grayscale has unveiled its updated list of the top 20 tokens with high growth potential, highlighting six new additions. Notably, two of these tokens – Jupiter ($JUP) and Jito ($JTO) – are part of the growing Solana ecosystem.

Solana-Based Tokens Shine Bright

Jupiter, a major decentralized exchange (DEX) aggregator on Solana, leads the network in Total Value Locked (TVL), showcasing its dominant role in the ecosystem. Meanwhile, Jito, a popular liquid staking protocol, made waves by generating over $550 million in fee revenues in 2024 alone, further solidifying its position in the market.

In addition to Jupiter and Jito, four other tokens have joined Grayscale’s top 20 list: Virtuals Protocol ($VIRTUALS), Grass ($GRASS), Ethena ($ENA), and Hyperliquid ($HYPE).

Driving Factors Behind Grayscale’s Selection

Grayscale’s latest report, published on December 30, 2024, outlined the criteria used to identify these high-upside tokens. The selection was influenced by three key trends:

- Impact of US Elections: The victory of Donald Trump in the recent elections and its implications for decentralized finance (DeFi) and staking platforms.

- Decentralized AI Innovations: Emerging advancements in artificial intelligence technologies tied to blockchain and DeFi projects.

- The Expansion of Solana’s Ecosystem: Solana’s growing prominence as a hub for next-generation blockchain applications.

Tokens showcasing one or more of these attributes are forecasted to perform exceptionally well in 2025, according to Grayscale.

Solana’s Resurgence: A Game-Changer?

The inclusion of Solana-based projects signifies a paradigm shift in the cryptocurrency landscape. Historically, Bitcoin ($BTC) and Ethereum ($ETH) have acted as the undisputed leaders in the space, but Solana may pose a strong challenge to the status quo.

After hitting a low point during the FTX collapse in 2022, Solana ($SOL) has witnessed a dramatic recovery, surging by 2,000% in value since then. Glassnode’s analysis reveals that in the 727 days following its 2022 dip, $SOL outperformed $BTC and $ETH on 344 occasions. This remarkable price action has cemented Solana’s position as a high-growth contender in the crypto industry.

2025: The Year of $SOL ETFs?

Grayscale’s interest in Solana could signal the potential for $SOL exchange-traded funds (ETFs), similar to its previous initiatives with $BTC ETFs. Industry experts believe $SOL ETFs could attract strong demand due to Solana’s comparatively lower market cap of $91 billion compared to Ethereum’s $403 billion. Even modest investments in Solana have the opportunity to significantly impact its price growth.

However, challenges remain. The $SOL ETF application is still under review by the U.S. Securities and Exchange Commission (SEC), with a preliminary decision expected by the end of January 2025.

Final Thoughts

The growing interest in Solana’s ecosystem and its inclusion in Grayscale’s coveted list indicates a transformative shift in the crypto industry. Investors are also eyeing $SOLX, a new Layer-2 scaling solution for Solana designed to address the network’s scalability issues, with predictions that it could be the next 100x token.

While the outlook for Solana and related tokens appears promising, investors should approach investments with diligence and conduct thorough research before committing funds. As always, consider diversifying your portfolio and understanding the risks associated with the volatile cryptocurrency market.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Boreal Wins $1 Million at Bitcoin 2024 Alpha Competition, Pioneers DeFi Innovation

At the highly anticipated Bitcoin 2024 conference this past July, Boreal, a market-neutral DeFi hedge fund, emerged as the winner of the Bitcoin Alpha Competition. Boreal impressed the judges with its innovative trading strategy and secured $1 million in seed capital, along with access to institutional-grade infrastructure provided by Samara Alpha Management.

The competition, hosted in collaboration with key industry partners, showcased leading entrepreneurs and projects pushing the boundaries of the Bitcoin and decentralized finance (DeFi) space.

A Winning Formula for DeFi Success

Boreal’s victory was attributed to its unique trading strategy, which leverages diverse DeFi protocols to generate yield across USD, bitcoin, and ether. Founder Evan Morris, a veteran of the crypto space since 2016 and a leader in traditional finance before that, highlighted the resilience of DeFi, even in bearish markets.

“Even when markets are down, there’s always a way to generate returns in DeFi,” Morris explained. “I started managing outside capital with two friends four years ago. Later, I became a portfolio manager at a larger firm, overseeing a DeFi-focused strategy. Launching Boreal allows us to take this approach to new heights, and with Samara’s support, we’re ready to scale significantly.”

Institutional Support Meets Innovative Vision

Adil Abdulali, Chief Investment Officer at Samara Asset Management and a judge at the competition, emphasized Morris’ proven expertise in DeFi.

“Evan has built a strong track record and has a solid risk framework for this type of strategy,” Abdulali noted. “His trading maturity is invaluable in a young and evolving market like crypto, where experienced players are still rare.”

Samara’s collaboration with Boreal extends beyond funding, providing essential resources like fund administration, auditing, accounting, subscription documentation, and secure accounts for managing crypto assets. Abdulali was clear in his commitment to accelerating Boreal’s growth, saying, “We want to get him up and running quickly with all the infrastructure he needs to succeed.”

Bitcoin’s Role in the Future of DeFi

Boreal’s outlook for the DeFi space is closely tied to bitcoin’s growing presence. Morris pointed out that bitcoin is now moving into DeFi in a way that could rival stablecoins’ previous dominance.

“DeFi 1.0 was heavily reliant on USDC and Tether,” Morris said. “The next phase will incorporate bitcoin derivatives and wrapped bitcoin for similar use cases. We’re excited to provide the liquidity needed for this transformation.”

Abdulali echoed this sentiment, reinforcing bitcoin’s importance as premier collateral.

“Bitcoin is unmatched as a financial asset and collateral," he said. "Our bitcoin-denominated and market-neutral funds already implement strategies that work seamlessly in the bitcoin ecosystem. Using bitcoin in DeFi protocols represents the future, especially in market-making strategies that previously relied on USDC or USDT.”

Unlocking the Potential of Institutional-Grade DeFi

The evolution of DeFi over the past four years has seen significant advancements in smart contract alerts, security evaluations, and wallet technology—all paving the way for institutional-grade products. Morris noted that these technological improvements equip Boreal to deliver highly secure and accessible products.

Abdulali believes that early adopters like Boreal stand to benefit immensely from the current DeFi landscape before traditional institutions fully embrace the sector.

“Institutions are still navigating bitcoin adoption, meaning they’re even further behind when it comes to DeFi,” Abdulali said. “For those of us operating in this space now, the potential for returns is substantial.”

The Path Forward for DeFi

As DeFi continues to mature, leaders like Boreal are setting the stage for a more dynamic and accessible ecosystem. With its innovative strategies and robust support from partners like Samara Alpha Management, Boreal is positioned to lead the charge in the next wave of DeFi evolution, all while harnessing the power of Bitcoin to reshape decentralized finance.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Two Republican members of Congress have requested a briefing from the U.S. Treasury Department regarding the recent cyberattack reportedly carried out by a China-linked hacking group. The lawmakers are seeking clarity on the extent of the breach and its potential implications for national security. This incident has raised concerns over cybersecurity vulnerabilities and the need for stronger digital defenses against foreign threats.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

2024 Crypto Innovations: BlockDAG, SpacePay, PENGU, and PEPETO Lead the Charge

The world of blockchain continues to evolve as innovative projects like BlockDAG, SpacePay, PENGU, and PEPETO redefine decentralized finance. These groundbreaking platforms offer distinct solutions for efficiency, scalability, security, and community engagement. Let’s dive into what makes each of them unique and why they’re becoming major players in the crypto space.

BlockDAG: Setting a New Standard in Blockchain Scalability

BlockDAG merges the reliability of traditional blockchain security with modern Directed Acyclic Graph (DAG) technology. This hybrid approach allows BlockDAG to deliver unparalleled speed, supporting thousands of transactions per second. Its use of a hybrid proof-of-work mechanism ensures scalability without compromising decentralization.

For anyone seeking cutting-edge blockchain solutions, BlockDAG promises to usher in a new era of efficiency and security.

SpacePay: Bridging Crypto and Fiat Payments for Merchants

SpacePay is transforming how merchants handle crypto transactions. This London-based project introduces a seamless payment system that enables businesses to accept cryptocurrencies and receive fiat currencies directly—shielding them from market volatility. Designed for maximum accessibility, SpacePay’s technology includes an Android-compatible APK, making it a practical tool for businesses around the world.

By offering merchants a simple and secure way to manage crypto payments, SpacePay is revolutionizing how crypto integrates into day-to-day commerce.

PENGU: The Creative Roadmap for Community-Driven Growth

PENGU enters the market with a visionary strategy titled “PENGUIANA.” Built on the Solana blockchain with 100 million tokens, the project’s roadmap prioritizes community engagement and creativity. With 60% of its total supply allocated to presales, PENGU fosters active participation among early adopters.

With its innovative storytelling, PENGU is set to make waves in the decentralized finance and NFT communities, ensuring a strong foundation for lasting community-driven development.

PEPETO: Redefining Memecoins with Utility and Innovation

The memecoin space is undergoing a transformation thanks to PEPETO. Known as the “ultimate frog god,” PEPETO combines the spirit of meme culture with practical value for investors. With unique features like zero-fee swaps, cross-chain bridges, and staking rewards of up to 484%, it offers a robust ecosystem for users and holders.

Key PEPETO Features:

- Staking Rewards: Generous staking options with payouts of up to 484%.

- Cost-Free Swaps: Zero-fee token exchanges for maximum user savings.

- Cross-Chain Bridges: Seamless swaps across multiple blockchains, enabling flexibility for asset holders.

- Presale Success: With over $3 million raised during its presale, PEPETO has garnered significant attention and trust from the crypto community. Tokens are currently available for an exceptionally low price of $0.000000101, offering a rare chance for early investors to experience potential exponential returns.

PEPETO is more than just a token—it’s a movement designed to address inefficiencies in the memecoin ecosystem. The mythical story of its origins, tied to ancient Sumerian texts on “Power and Energy,” adds a layer of intrigue and engagement for its growing community. PEPETO also plans listings on five major exchanges post-presale, ensuring liquidity and accessibility for holders.

Why These Projects Are Game-Changers

These trailblazing projects cater to various aspects of the blockchain world:

- BlockDAG delivers scalability and decentralization through innovative architecture.

- SpacePay simplifies crypto-to-fiat conversions, making cryptocurrencies practical for merchants.

- PENGU emphasizes creativity and community, breathing new life into blockchain-based ecosystems.

- PEPETO integrates compelling narratives with a sustainable ecosystem, raising the bar in memecoins.

The Future of Blockchain and Crypto Innovation

Whether you’re an investor or a blockchain enthusiast, projects like BlockDAG, SpacePay, PENGU, and PEPETO illuminate the path ahead for decentralized finance. They combine utility, growth potential, and forward-thinking strategies to make cryptocurrency accessible, efficient, and rewarding.

If you’re looking for promising opportunities in the crypto market, these projects offer the kind of innovation that can lead to exponential returns and transformative growth.

Disclaimer: This is a sponsored article and does not constitute investment advice. Always conduct thorough research before making financial decisions.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Bitcoin is striving to recover from its recent price correction and aims to reclaim the $100,000 milestone. However, the success of this upward movement largely depends on breaking through key price levels. Investors and traders are closely monitoring these critical thresholds to gauge the potential trajectory of Bitcoin’s price.

Stay updated on the latest developments as the market navigates this pivotal phase.

Image Caption: Bitcoin bulls face significant challenges in their attempt to push prices back to $100,000.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

In the cryptocurrency ecosystem, every project operates with a specific tokenomics model that governs the rules for token issuance and distribution. A foundational part of tokenomics is the concept of **vesting**. Vesting refers to a predefined period during which tokens owned by investors, venture capitalists, or business angels remain locked, preventing their immediate sale. These tokens are gradually unlocked following a set schedule. Since this information is publicly accessible, it becomes crucial to monitor release schedules as they can heavily influence market trends, especially if significant sales follow shortly after. Here’s a detailed look at the key token releases scheduled for January 2025.

Ethena (ENA): $13M Unlock on January 8

The year 2025 will begin with a token release from **Ethena**, the team behind the decentralized stablecoin USDe. On January 8, approximately **12.86 million ENA tokens** (its governance token) will be unlocked. At current pricing, this accounts for a total value of **$13.4 million**.

Movement (MOVE): $45M Unlock on January 9

On January 9, Layer-2 platform **Movement** will release **50 million MOVE tokens**, valued at approximately **$45 million**. This large unlocking event is expected to be one of the most notable of the month.

Optimism (OP): $8.37M Unlock on January 9

Also on January 9, Layer-2 scaling solution **Optimism** will unlock **4.47 million OP tokens**, totaling **$8.37 million** at current prices. These funds are predominantly allocated to the protocol’s investors and contributors, further extending Optimism’s influence in the crypto market.

Aptos (APT): $105M Unlock on January 11

The biggest unlocking event of January will occur on January 11, with Layer-1 blockchain **Aptos** set to release **11.21 million APT tokens**. At current pricing, this massive release is valued at a staggering **$105 million**, making it the highlight of the month.

Sei (SEI): $24M Unlock on January 15

On January 15, Layer-1 platform **Sei** will unlock **55.56 million SEI tokens**, valued at **$24 million**. This release adds to the series of significant token unlocks expected in January 2025.

AltLayer (ALT): $28M Unlock on January 25

The final major token release of January comes from **AltLayer** on January 25. During this event, the protocol will unlock **240 million ALT tokens**, worth more than **$28 million**. This represents another key date for investors to monitor.

The planned token unlocks for January 2025 provide valuable insights into potential market movements. Significant releases like these often follow with increased selling pressure from investors, which could contribute to market volatility. Staying informed about these events is essential for making strategic investment decisions in the cryptocurrency space.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

**Understanding the Bitcoin Power Grid Indicator: Bullish Momentum for Bitcoin Remains Strong**

The Bitcoin Power Grid is a technical analysis indicator widely used by traders to evaluate the price trends of Bitcoin (BTC) during different market cycles. It uses a scale ranging from 0% to 100%, enabling investors to identify both historical price peaks and lows.

Currently, the Bitcoin Power Grid is positioned at 82.5%, signaling that Bitcoin is still far from reaching its maximum price in this cycle. Prominent analyst CryptoCon highlights that historical data suggests price rallies tend to extend further as the indicator approaches 100%. This level represents a “First Cycle Maximum” for Bitcoin.

Experts anticipate 2025 to be a landmark year for cryptocurrencies, with Bitcoin potentially reaching new all-time highs (ATHs). According to CryptoCon, Bitcoin’s upward momentum will likely continue until the indicator fully reaches the 100% threshold.

### Historical Trends in Bitcoin Price Peaks

Each time the Bitcoin Power Grid has attained 100%, Bitcoin has marked a significant price record. As of now, Bitcoin’s ATH stands at $108,200, achieved on December 3. At that time, the indicator surpassed 90%, signaling the potential for even more growth.

Currently, Bitcoin’s price hovers above $97,000, suggesting strong market confidence and expectations of another ATH in the near future.

### Bullish Outlook Driven by Halving Cycles

Historical market trends show that Bitcoin typically reaches its price peak in the year following the halving event. This event, which reduces Bitcoin’s issuance rate by 50%, often creates scarcity in the market, increasing demand and pushing prices higher.

The next cycle-driven price rally could see Bitcoin draw even more investors, drawn by its limited supply and growing adoption as a store of value.

### Regulatory Optimism Fuels Growth

The macroeconomic outlook for Bitcoin is also bolstered by favorable policy signals. Notably, the upcoming administration in the United States has committed to supporting cryptocurrency-friendly regulations. Among key developments is the proposal to use government-seized Bitcoin as part of a strategic national reserve.

Further reinforcing market confidence is a legislative effort advocating for the acquisition of 1 million Bitcoin units for a strategic reserve. Such initiatives signal growing institutional interest in Bitcoin, further fueling market projections for a bull run.

### Summing Up

With the Bitcoin Power Grid sitting at 82.5%, indicating strong but incomplete bullish momentum, analysts foresee profound growth potential in the coming months. Coupled with regulatory support and historical market trends, Bitcoin’s path to new ATHs appears increasingly imminent.

Investors should closely monitor technical and macroeconomic signals as the cryptocurrency rollercoaster continues to climb towards what might be an extraordinary journey in the next market cycle.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Bitcoin Adoption: Predictions for 2025 by Galaxy Research

Jianing Wu, an associate researcher from Galaxy Research, has made a bold and optimistic prediction regarding Bitcoin’s future. Wu forecasts that by 2025, five nation-states will adopt Bitcoin, a strong signal of growing institutional acceptance. Furthermore, Wu believes five companies listed on the Nasdaq 100 could integrate Bitcoin into their reserves, marking another step in large-scale adoption starting as early as 2024.

“Five Nasdaq 100 companies and five nation-states will announce that they have added Bitcoin to their balance sheets or sovereign wealth funds. Whether for strategic purposes, portfolio diversification, or trade settlement, Bitcoin will begin to find a place on the balance sheets of major corporations and sovereign entities. Competition, particularly among non-aligned nations or those with significant sovereign wealth, as well as nations with adversarial relationships with the United States, will encourage strategies to acquire or mine Bitcoin,” Wu stated.

This outlook is one of the most optimistic projections for Bitcoin adoption by countries in the coming years.

Key Predictions for Bitcoin and Cryptocurrency in 2025

Galaxy Research recently presented 23 forecasts for Bitcoin and altcoins in 2025, touching on pivotal financial and geopolitical milestones. According to the report, the reelection of Donald Trump and the anticipated launch of Bitcoin Exchange-Traded Funds (ETFs) in the U.S. are key events expected to shape the cryptocurrency market in 2024.

Further insights come from analyst Alex Thorn, who shared his optimistic view on institutional adoption starting in 2025. Thorn envisions financial advisors recommending Bitcoin allocations within investment portfolios.

“At least one prominent wealth management platform will recommend a Bitcoin allocation of 2% or more for its clients. Due to factors such as compliance requirements, internal education, and maturing markets, wealth management firms have yet to incorporate Bitcoin into their advised model portfolios. This shift will occur in 2025, driving increased investment flows into U.S.-based spot Bitcoin ETFs.” Thorn explained.

Additionally, researcher Gabe Parker predicts significant technical updates to the Bitcoin protocol in 2025, with innovations such as OP_CTV (BIP 119) and OP_CAT (BIP 347) gaining developer traction by late 2024.

Tether’s Market Dominance May Diminish

Another striking prediction highlights a potential disruption in the stablecoin market. Charles Yu foresees Tether, the issuer of USDT, losing its dominance by 2025.

“Tether’s market share could drop below 50%, challenged by new contenders like Blackrock’s BUIDL, Ethena’s USDe, and USDC Rewards from Coinbase. Tether, which retains yield revenue from USDT reserves for its portfolio investments, may see users migrate toward more rewarding alternatives. Emerging products promising yield-based rewards will incentivize user conversion, impacting Tether’s position. To counter competition, Tether could share income from USDT reserves with holders or release yield-rich stablecoin solutions,” Yu stated.

These changes in the stablecoin market would likely accelerate innovation in decentralized finance (DeFi) and create new financial models for retail and institutional adoption alike.

2025: A Historic Year for Bitcoin?

The year 2025 could be pivotal for Bitcoin, driving the cryptocurrency further into mainstream use among nations, corporations, and investors. With global developments such as sovereign Bitcoin adoption, institutional backing, and system updates on the horizon, Bitcoin shows no signs of slowing down.

As the cryptocurrency landscape continues evolving, these predictions reflect a growing trust in Bitcoin’s role as a tool for financial innovation, global economic strategy, and portfolio diversification. While challenges remain, 2025 might well mark a turning point in how the world perceives and adopts digital assets.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

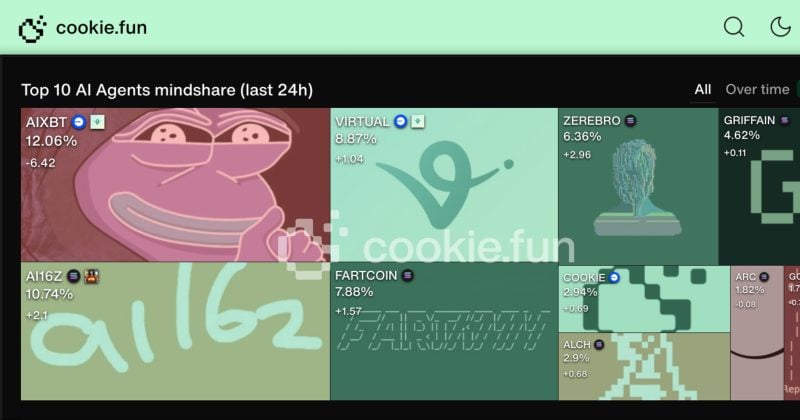

AI Agents and the Future of Cryptocurrencies: What to Expect by 2025

Artificial intelligence (AI) is poised to revolutionize the cryptocurrency industry in 2025, according to predictions by Dragonfly Managing Partner, Haseeb Qureshi. He foresees AI agents becoming a dominant force within the crypto community, fundamentally reshaping its operations and narratives.

The Shift from Meme Coins to Advanced AI Systems

Qureshi acknowledges that, for now, AI applications in the blockchain space primarily involve chatbots tied to meme coins. However, these systems are largely controlled behind the scenes by humans. He highlights a notable exception—projects like "Freysa," which represent a departure from this trend.

As the technology evolves, Qureshi predicts that chatbots will replace crypto influencers and bring an end to the popularity of meme coins. By 2026, however, the widespread presence of such AI agents may provoke backlash, leading to a renewed appreciation for content created by real individuals. AI systems themselves could adapt to this shift by pretending to be influencers or evolving into sophisticated "scambots."

“In the future, AI chatbots won’t rely on meme coins for monetization. Instead, they’ll operate like key opinion leaders, leveraging sponsorships, affiliate marketing, and token promotions. Accusations of false influencers being AI-controlled will become a recurring scandal,” Qureshi noted.

AI Innovations in Market Efficiency and Development

Qureshi envisions AI having its greatest long-term impact outside of social media and crypto trading platforms. He believes that AI won’t transform everyone into a successful trader or hedge fund manager. Instead, it will scale users’ capabilities, but this scalability will depend on access to capital, data, and infrastructure.

Existing trading firms with deep resources will benefit most, as AI makes markets more efficient, even in niche sectors. Retail investors, in turn, may face increasing challenges as their competitive advantages diminish.

Meanwhile, the largest breakthroughs could occur in software development. AI-powered tools are expected to cut development costs drastically. Qureshi anticipates that launching an app could require a fraction of current investments—possibly as little as $10,000 for AI cloud computing. This affordability will lead to a surge in application ecosystems and on-chain experiments, reshaping the tech landscape.

“In a post-AI world, the cost of launching software projects will plummet, catalyzing what I call an on-chain renaissance,” Qureshi said.

The Impact on Decentralized Finance and Stablecoins

Cryptocurrency could also influence AI development. Autonomous systems might use digital assets for transactions, particularly as regulatory frameworks for stablecoins evolve. Lenient policies could set the stage for "explosive growth" within the sector, particularly benefiting major players.

Qureshi also believes that self-funded projects such as Hyperliquid and Jupiter, which are currently considered exceptions, will become standard industry practice. Their emergence will encourage experimentation and application diversity.

The Road Ahead

AI’s influence on cryptocurrency is expected to bring "real innovation" to the industry, transforming its core mechanisms. While such changes promise to democratize software creation and enhance efficiency, they also raise concerns about transparency, competition, and ethical considerations.

The fusion of AI and blockchain will undoubtedly unlock new possibilities, but striking a balance between technological advancement and values such as authenticity and decentralization will be critical in navigating this rapidly changing landscape.

What’s certain is that both AI and cryptocurrency are on the brink of a major transformation, paving the way for an exciting and unpredictable future for the digital economy.

Stay informed about the latest trends in AI and cryptocurrency—this is your guide to the future of blockchain innovation.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

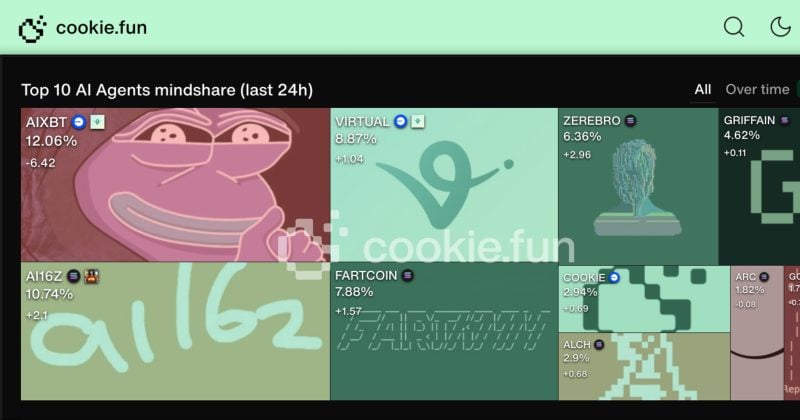

COOKIE Token Soars 420% in a Week Amid $14.3M Staking Surge

The COOKIE token has experienced an explosive 420% surge in value over the past week, bolstered by $14.3 million worth of staking activity, as per recent data. This unprecedented growth saw the token’s price jumping from $0.11 to $0.59 in just a few days.

This meteoric rise is largely attributed to two key catalysts: the launch of the innovative DataSwarm Framework and the token’s listing on Binance Alpha. The latter introduces early-stage crypto projects to a broader audience, enhancing visibility and potential adoption.

Staking Boosts COOKIE’s Traction

The COOKIE token, which powers the Cookie DAO protocol, has seen a remarkable staking volume exceeding 25.3 million tokens. This level of staking signifies growing user interest and confidence in the project’s long-term potential.

One of the unique features of the protocol is its v0.3 data infrastructure, requiring users to stake a minimum of 10,000 COOKIE tokens for access. This framework aggregates AI agent indexes, making it a pivotal tool for data-driven development and analytics in the blockchain space.

What’s Fueling COOKIE’s Growth?

- Innovation: The DataSwarm Framework provides a dynamic, AI-oriented infrastructure that appeals to developers and institutions, driving demand for COOKIE tokens.

- New Exchange Listing: The listing on Binance Alpha, a new feature showcasing high-potential early-stage projects, has significantly amplified market excitement and adoption.

- Staking Utility: COOKIE’s staking mechanism not only incentivizes participation but also strengthens the token’s position in the decentralized finance ecosystem.

As COOKIE cements its position as a top performer in the crypto space, its ambitious roadmap and utility-focused ecosystem continue to attract attention from a growing community of investors and blockchain enthusiasts.

Key Metrics at a Glance:

- Price Change: 420% increase over the past week.

- Current Price: $0.59 per COOKIE token.

- Staking Value: $14.3 million, with over 25.3 million tokens staked.

Stay tuned as this fast-growing token continues to shape the future of decentralized data and AI-driven solutions. #CryptoInnovation

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

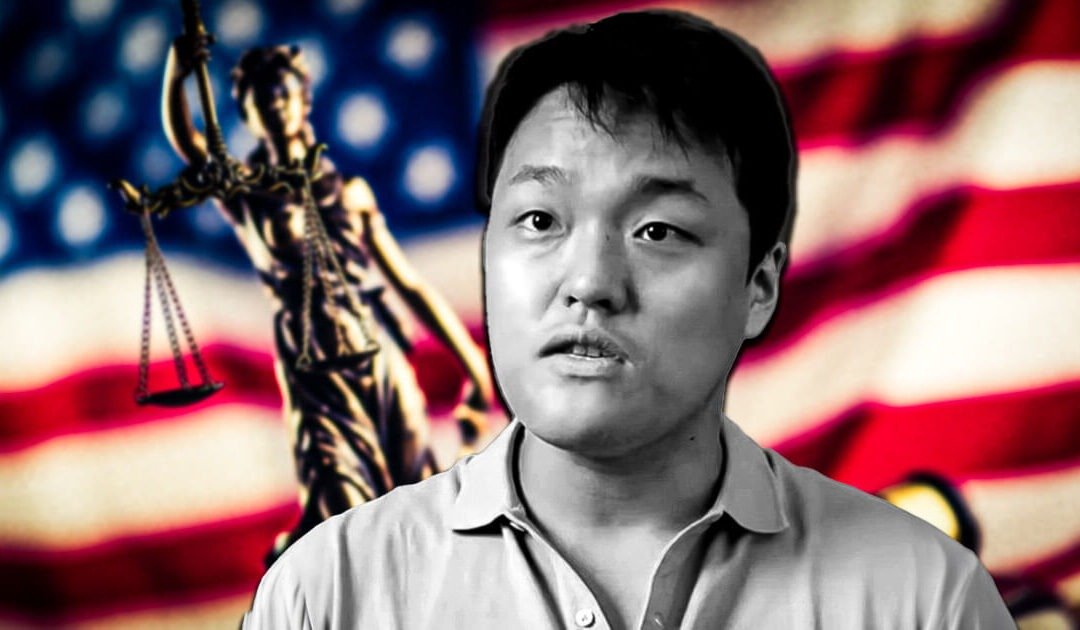

Do Kwon Faces U.S. Court in Crypto Fraud Case Linked to Terra Collapse

On January 2, Terraform Labs co-founder Do Kwon made his first appearance in a U.S. court, where he pleaded not guilty to fraud charges tied to the staggering $40 billion collapse of the TerraUSD (UST) stablecoin. Kwon, who is now at the center of one of the most high-profile crypto scandals, faces nine charges, including wire fraud, securities fraud, and commodities fraud. These charges stem from his alleged involvement in the implosion of Terraform Labs and its tokens, LUNA and UST.

Background: Arrest and Extradition

Do Kwon’s legal troubles began after his arrest in Montenegro in March 2023. He was detained while attempting to leave the country using a fake passport. His arrest sparked an international tug-of-war between U.S. and South Korean authorities, both of whom sought to prosecute him for fraud. While South Korea pushed for extradition due to Kwon’s citizenship, U.S. authorities sought him for his alleged role in misleading investors about Terra’s blockchain capabilities and adoption rates.

In a significant ruling, Montenegro’s Constitutional Court rejected Kwon’s appeal to avoid extradition to the U.S. The country’s Justice Minister subsequently signed the order to extradite him in late December 2023. Kwon was officially handed over to U.S. authorities on December 31 at Podgorica International Airport, where he was flown to face trial in New York.

Fraud Allegations and Legal Consequences

Prosecutors claim that Kwon misled investors, directly contributing to Terra’s dramatic downfall. The Southern District of New York is prosecuting the case, the same office that successfully brought charges against other crypto industry figures in earlier high-profile cases. Alongside his criminal trial, Kwon and Terraform Labs have already been found liable in a civil fraud case initiated by the Securities and Exchange Commission (SEC). The ruling imposed a historic $4.47 billion settlement on the company and Kwon personally, adding more weight to the ongoing legal battles.

Terraform Labs, once a leading name in blockchain innovation, has since filed for bankruptcy.

The Road Ahead

Do Kwon remains in custody without bail as legal proceedings unfold. A court conference is scheduled for January 8, which is expected to set the tone for this highly anticipated crypto fraud trial. If convicted, the Terraform Labs co-founder faces severe consequences, as authorities continue to crack down on financial misconduct in the cryptocurrency space.

This case has once again highlighted the importance of accountability and transparency in the crypto industry, while serving as a stark reminder of the risks involved in speculative digital assets.

This article is designed to provide updates on Do Kwon’s legal journey and its wider implications for the cryptocurrency market.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

BlackRock’s Bitcoin ETF Hits Over $50 Billion in Assets: A Historic Achievement

BlackRock’s iShares Bitcoin Trust (IBIT) has revolutionized the Exchange-Traded Funds (ETFs) market, setting a record-breaking benchmark since its launch in January 2024. In an unprecedented feat, the fund has accumulated more than $50 billion in assets within just 11 months. This substantial growth not only outpaces traditional funds that have been in operation for decades but also marks a transformative moment in the financial industry.

From Skepticism to Widespread Success

BlackRock’s entry into the Bitcoin market represents a pivotal shift in the adoption of cryptocurrency within the global financial ecosystem. With $11 trillion in assets under management, the firm’s embrace of Bitcoin has pushed the largest cryptocurrency past the $100,000 mark for the first time. This historic milestone has not only fueled Bitcoin’s institutional adoption but has also reshaped investor perceptions of digital assets.

The journey to U.S. Bitcoin ETFs has been far from smooth. Early efforts by the Winklevoss brothers back in 2013 faced repeated rejections from regulators, while Grayscale Investments secured a significant legal victory in 2023, paving the way for spot-Bitcoin ETFs. With regulatory approval granted in early 2024, companies like BlackRock, Fidelity, and VanEck launched their Bitcoin ETFs, collectively amassing over $107 billion in assets within the year.

IBIT’s Rapid Growth and Industry Impact

IBIT has emerged as the fastest-growing ETF in history, growing five times quicker than the next closest fund, which took nearly four years to achieve similar asset levels. Already surpassing BlackRock’s gold ETF—historically one of the largest global gold funds—IBIT has firmly established itself as a game-changer in the crypto and ETF markets.

Its influence on market dynamics is profound. IBIT has played a significant role in Bitcoin’s 118% year-to-date price rally. Additionally, it accounts for over 50% of the daily trading volume among Bitcoin ETFs, showcasing its dominance over competitors. Notably, IBIT also introduced Bitcoin ETF options trading, which quickly became a top-performing segment, recording $1.7 billion in daily notional volume.

Significance in the Financial Landscape

The success of IBIT has outpaced over 50 European-focused ETFs that have been operational for over two decades. ETF industry experts highlight that the iShares Bitcoin Trust is setting a precedent for financial innovation. Its unparalleled growth rate and significant contribution to trading activity highlight a growing demand for Bitcoin among investors previously wary of the cryptocurrency.

At the time of reporting, Bitcoin continues to trade close to the $100,000 milestone, solidifying its position as the leading cryptocurrency globally. Its success, largely attributed to platforms like IBIT, is a testament to increasing institutional acceptance and a maturing crypto market.

A Future Shaped by Bitcoin ETFs

BlackRock’s success with IBIT serves as a blueprint for the rapidly evolving cryptocurrency investment landscape. With Bitcoin ETFs gaining traction, the financial world is witnessing a shift as traditional investors and institutions embrace the digital asset revolution. The rise of Bitcoin-focused ETFs is likely to drive further growth in global markets, making cryptocurrency an essential component of diversified investment portfolios.

As the market advances, BlackRock’s early move into the space not only sets the tone for future ETF launches but also underscores the transformative potential of Bitcoin in reshaping global finance. Whether you’re a seasoned investor or new to the world of crypto, this development signals that the era of institutional cryptocurrency investment is here to stay.

Bitcoin prices referenced are subject to market fluctuations.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

Women Leading the Bitcoin Movement in 2024: A Global Showcase

In a space historically dominated by men, women from around the world have been making remarkable strides in the Bitcoin ecosystem. From Africa to Latin America, Southeast Asia, and beyond, these women are proving that Bitcoin is shaping lives and economies in profound and transformative ways. Here’s an inspiring list of trailblazing women who have been pivotal in advancing Bitcoin adoption and education in 2024.

Farida Bemba Nabourema — Empowering Bitcoin Adoption in Africa

Farida Nabourema from Togo is a dedicated human rights defender and activist. As the lead organizer of the African Bitcoin Conference, she has connected Bitcoin enthusiasts from across the continent with global developers and advocates. This platform has become a critical space for Bitcoin conversations and education in Africa.

Reyna Chicas — Educating El Salvador

Reyna Chicas, based in El Salvador, was recently promoted to Director of Education for Mi Primer Bitcoin. Two years ago, she attended a conference as a participant, and today, she is at the forefront of Bitcoin education and also serves on the board of the organization. Her work inspires a new wave of Bitcoin users in El Salvador.

Roya Mahboob — A Tech Pioneer for Afghan Women

Roya Mahboob was among Afghanistan’s first female tech CEOs. She founded the Digital Citizen Fund to empower Afghan women through technological literacy. In 2024, she expanded her efforts to schools in Bangladesh, India, Pakistan, and Nepal, opening IT centers for young girls to foster future tech leaders.

Give Rezkitha — Building Bitcoin Communities in Southeast Asia

Give Rezkitha is a key force in promoting Bitcoin in Indonesia. As the Community Master for Southeast Asia, she co-founded the Indonesian Bitcoin Community and played a significant role in organizing the Indonesia Bitcoin Conference. Globally, she represented Southeast Asia at major Bitcoin events like the Oslo Freedom Forum and Bitcoin 2024.

Lorraine Marcel — Revolutionizing Bitcoin Education in Africa

Kenyan innovator Lorraine Marcel founded Bitcoin Dada as a platform for educating African women about Bitcoin. Her efforts earned her the Most Impactful African Bitcoiner of 2024 award. Lorraine’s work is empowering women to become leaders in the Bitcoin space, creating ripple effects throughout the continent.

Isabella Santos — Leading Bitcoin Media in Mexico

Isabella Santos, co-founder of BTC Isla, a Mexican Bitcoin community, and Get Based, a Bitcoin media outlet, is a powerhouse in the Latin American Bitcoin movement. She made waves globally as the host of “Bitcoin Backstage,” offering behind-the-scenes insights from the world’s top Bitcoin conferences.

Noelyne Sumba — Expanding Bitcoin Access in Kenya

Based in Kenya, Noelyne Sumba focused on promoting Bitcoin adoption through mobile wallets compatible with feature phones, enabling financial inclusion in underserved regions. Her translation of "The Bitcoin Standard" into Swahili further strengthened Bitcoin education in East Africa.

Masieh Christ — Supporting Women through Bitcoin

Masieh Christ, with Mauritian and Ugandan roots, advocates for using Bitcoin for peacebuilding. Her organization empowers women in Somalia by teaching them how to use Bitcoin for political fundraising to support female candidates. She also delivered a compelling talk on Bitcoin’s role in counter-terrorism efforts at the Oslo Freedom Forum.

Janet Maingi — Electrifying Rural Africa through Bitcoin

Kenyan entrepreneur Janet Maingi co-founded Gridless Compute, which combines Bitcoin mining with sustainable energy solutions. In 2024, her company not only mined Bitcoin profitably but also brought electricity to rural communities in Africa, showcasing the potential of Bitcoin mining in fostering development.

Mary Imasuen — Amplifying Bitcoin on the Global Stage

Mary Imasuen, of Nigerian and Filipino heritage, serves as the Global Marketing Manager for Fedi. She uses her role to champion Bitcoin education and regularly speaks at industry events. Her passion for Bitcoin-only gaming has also gained her recognition across the Bitcoin and gaming communities.

Honorable Mentions:

- Renata Rodrigues (Brazil) — Head of Marketing at Fedi and a staunch community advocate.

- Lorena Ortiz (Mexico) — Latin America Community Master of Fedi.

- Edith Mpumwire (Uganda) — Community Manager at Bitcoin Dada.

- Sabina Gitau (Kenya) — Co-founder of Tando, promoting sustainability in Bitcoin.

- Isabella Chekovich (Russia) — Advocate for privacy in Bitcoin transactions, part of the Human Rights Foundation’s Freedom team.

- Ella Hough (USA) — Helped launch Cornell University’s independent Bitcoin study program.

Women’s Role in Bitcoin’s Global Evolution

Although this piece highlights a few incredible women, countless others are making a significant impact but remain under-acknowledged. These pioneers, however, share a common determination: to use Bitcoin as a tool for financial freedom, innovation, and empowerment across diverse communities worldwide.

Let’s celebrate their achievements and advocate for greater gender equity in the financial revolution driven by Bitcoin.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

In 2025, Polymarket has projected a 77% likelihood of a U.S. SOL ETF being listed, a probability that Matthew Sigel considers undervalued.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

A recent report from a prominent blockchain analysis platform reveals that Pump.fun has achieved impressive revenues exceeding 2 million SOL, valued at nearly $400 million. This significant milestone highlights the growing impact of blockchain-based platforms in the financial ecosystem.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

Former Silk Road Founder Ross Ulbricht to Be Released from Prison on January 30th

After more than a decade behind bars, Ross Ulbricht, the creator of the infamous Silk Road dark web marketplace, is set to be released from prison on January 30th. This decision follows a promise made by former President Donald Trump during his campaign, marking an important milestone in the ongoing discussions surrounding digital crime and justice.

From Trump’s Promise to Reality: The Release of Ross Ulbricht

Ross Ulbricht, the founder of Silk Road, a once-prominent and controversial online drug marketplace operating on the dark web, has spent the last 11 years in prison. Known for utilizing Bitcoin to enable anonymous transactions, his platform became a hub for illicit trade, including drugs, counterfeit documents, and more.

Ulbricht’s release is the culmination of years of lobbying by supporters who criticized his life sentence as overly harsh compared to other similar cases. During his campaign, former President Trump vowed to commute Ulbricht’s life sentence, a promise that has now been fulfilled shortly after his recent return to office.

Ulbricht, who was convicted in 2015 of seven charges, including computer hacking, money laundering, and drug trafficking, received a life sentence without parole. However, critics of his punishment argued that the sentence was disproportionate, emphasizing that he never personally dealt in drugs but merely provided the digital space for transactions.

A Grassroots Movement: The Campaign for Ulbricht’s Release

Over the years, Ross Ulbricht’s case garnered widespread attention, particularly from libertarians and cryptocurrency advocates. His mother, Lyn Ulbricht, became the face of the "Free Ross" movement, mobilizing over 600,000 signatures in a petition demanding his release.

For Ulbricht’s supporters, his case has always symbolized excessive punishment and a broader critique of the justice system’s approach to emerging digital technologies.

Silk Road: A Digital Revolution or a Criminal Enterprise?

Launched in 2011, Silk Road became the first dark web marketplace to leverage Bitcoin, allowing users to anonymously engage in transactions. The platform operated on principles of anonymity and an “anarcho-capitalist” ideology, which its founder argued sought to eliminate violence often associated with the traditional drug trade.

For over two years, it served as a major hub for illegal activities, including drug sales and money laundering services. Operating under the pseudonym “Dread Pirate Roberts,” Ulbricht envisioned Silk Road as a space free from government control, where so-called “victimless crimes” could exist.

The government, however, viewed it differently. Prosecutors alleged that Ulbricht also used the platform to commission murder-for-hire plots to protect Silk Road, though no charges of murder were ever filed in court. For some, Ulbricht was a visionary attempting to disrupt the traditional drug industry; for others, he was a criminal responsible for contributing to overdoses and deaths.

Mixed Reactions to the News

Ulbricht’s upcoming release has sparked divided opinions. Libertarians and cryptocurrency supporters view it as a win for justice, celebrating what they see as an acknowledgment of an overly harsh sentence. On the other hand, families of overdose victims believe the decision sets a dangerous precedent, claiming it undermines accountability for the consequences of Ulbricht’s actions.

In a heartfelt message shared through his wife on social media, Ulbricht expressed gratitude for his second chance:

“After more than 11 years of darkness, I can finally see the light of freedom at the end of the tunnel. Thank you, President Trump, for this second chance.”

What’s Next for Ross Ulbricht?

The release of Ross Ulbricht represents a turning point in the evolving narrative around digital crime, privacy, and the justice system’s handling of such cases. It remains to be seen how he will use this second opportunity and what role he may play in an increasingly digital and decentralized world.

For now, his story stands as a reminder of the complex intersection between emerging technologies, freedom, and the rule of law.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

Creating a visual representation of your detailed description would focus on the dominance of Solana within the crypto market, its sharp price movements, and the broader attention on altcoins. Alongside this, visual emphasis on the hype surrounding memecoins like "Fartcoin" and the overall volatility of the cryptocurrency landscape could be highlighted. Here’s an idea:

Visual Concept:

- Background: A futuristic digital landscape with glowing graphs and a dynamic chart, emphasizing Solana’s fluctuating price trajectory.

-

Foreground Elements:

- A large glowing Solana logo (SOL) prominently placed as a symbol of focus.

- Smaller icons or logos for Ripple (XRP), Cardano (ADA), and Bitcoin (BTC) alongside Solana, illustrating their recent rise in market attention.

- A playful, animated depiction of Fartcoin (perhaps as a cartoonish coin with motion lines or humorous graphics), representing the memecoin’s rise.

- Price charts showing sharp increases and corrections, symbolizing market volatility.

- Headlines in the form of glowing holograms: "Altcoin Gains," "Memecoin Craze," and "Crypto Market Outlook."

-

Details:

- Include a mix of warm colors (representing excitement) and cooler tones (showing uncertainty), presenting the dual nature of the crypto market (high risk & high reward dynamics).

- Subtle indicators for key milestones like $263 (Solana’s all-time high) and under $180 (post-correction) to emphasize critical technical levels.

- Additional Touch: A futuristic clock or calendar subtly hinting at timeline-critical regulatory and political decisions shaping the crypto market’s future.

Let me know if you need help producing the artwork!