by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Semilore Faleti: Crypto Journalist, Advocate, and Visionary

Semilore Faleti is an accomplished cryptocurrency writer with a focused expertise in journalism and content creation. While he began his career writing on various subjects, he soon discovered a deep passion for unraveling the complexities of blockchain technology and the dynamic world of cryptocurrencies.

A Vision for Digital Efficiency

Semilore is captivated by the efficiency that digital assets bring to the processes of storing and transferring value. As a staunch advocate of cryptocurrency adoption, he firmly believes in its potential to drive the digitalization and transparency of today’s financial systems. His advocacy underscores the transformative power of blockchain technology to reshape global finance.

Extensive Coverage in Crypto Journalism

Over the past two years, Semilore has made a significant impact in the crypto journalism space. His expertise extends across a wide array of topics within the blockchain ecosystem, including:

- Blockchain technology

- Decentralized Finance (DeFi)

- Staking

- Non-Fungible Tokens (NFTs)

- Cryptocurrency regulations

- Network upgrades

Whether explaining the fundamentals or analyzing cutting-edge developments, Semilore’s writing bridges the gap between beginner-friendly education and in-depth reporting for seasoned crypto enthusiasts. His contributions remain invaluable to readers at all levels of expertise. He aims to simplify complex topics, ensuring accessibility while delivering accurate and meaningful information.

A Strong Foundation in Content Writing

Semilore’s early career as a content writer equipped him with the ability to create educational articles that resonate with a wide audience. For complete newcomers, Semilore’s work offers well-structured, easy-to-follow explanations of cryptocurrency. For experienced users, he ensures that they stay informed about the latest decentralized applications, blockchain upgrades, and other key trends in the digital asset space.

This foundation in accessible content creation continues to shape his work, maintaining a balance that educates, informs, and engages.

Reporting on the Latest Developments

Currently, Semilore channels his expertise into reporting major developments in the cryptocurrency market. He provides in-depth coverage of:

- Price trends and market analysis

- On-chain developments

- Large-scale activity from institutional investors or “whale” movements

- Cryptocurrency token analysis and predictions from leading market analysts

In every report, Semilore aims to provide actionable insights and reliable information for readers navigating the volatile world of digital assets.

Beyond Blockchain: Passions and Advocacy

Outside of his work, Semilore is a multifaceted individual with various interests. A true "music nomad," he has a passion for music and enjoys exploring a wide range of genres. Whether it’s discovering new artists or delving into emerging music trends, Semilore’s love for creativity extends beyond his journalism.

Semilore is also a vocal advocate for social justice, fairness, inclusivity, and equity. He actively engages in promoting conversations around combating systemic inequality and discrimination. These values drive his mission to encourage community participation in shaping fairer societal policies.

Additionally, Semilore believes in the power of political engagement to enact meaningful and lasting changes. His advocacy focuses on encouraging people of all backgrounds to participate in governance and policymaking processes actively.

A Trusted Voice in Crypto and Beyond

Semilore Faleti represents a rare combination of expertise, passion, and advocacy. His dedication to simplifying cryptocurrency and driving its adoption is matched by his commitment to promoting fairness, equality, and increased political participation.

Through meticulous research and an engaging writing style, Semilore consistently delivers relevant insights into the rapidly evolving blockchain landscape. His contributions aim to educate, inspire, and empower readers in understanding and embracing the digital financial future.

As an advocate, journalist, and thought leader, Semilore continues to make an indelible mark in the cryptocurrency industry. His work serves as a beacon for a transparent, inclusive, and equitable financial system for generations to come.

Keywords for SEO: Semilore Faleti, cryptocurrency writer, crypto journalist, blockchain technology, cryptocurrency adoption, decentralized finance (DeFi), NFTs, social justice, transparency in finance, digital assets, crypto price analysis, blockchain news, equitable finance transformation.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

FTX’s $16 Billion Creditor Repayment Plan Fuels Hope and Skepticism in the Crypto Market

The cryptocurrency community is abuzz with speculation as FTX, the collapsed digital asset exchange, prepares to begin its much-anticipated $16 billion repayment plan to creditors. While the news has sparked excitement among some, others remain skeptical about the timeline and potential outcomes of these reimbursements.

The $16 Billion Repayment Initiative

FTX, once valued as a leading cryptocurrency exchange, fell from grace under the now-convicted leadership of Sam Bankman-Fried. As the company seeks to resolve its obligations, industry analysts have voiced optimism about how these repayments might provide a much-needed boost to the broader crypto market. Many believe a portion of the funds returned to creditors could be redirected into digital assets, fueling liquidity and promoting bullish trends across the ecosystem.

However, not everyone is convinced of this optimistic projection. Uncertainty clouds the process as industry participants question whether the repayments will commence per schedule or face delays. Some creditors have raised concerns regarding compliance steps, including the Know-Your-Customer (KYC) requirements, and the exact timeline for distributions.

Reorganization and Timeline of Payments

FTX Trading Ltd. has confirmed that their court-approved Chapter 11 Plan of Reorganization will officially take effect on January 3, 2025. This date will serve as the initial distribution record date for creditors with recognized claims under specific Convenience Classes. However, the actual disbursement is expected to occur within 60 days of this effective date, dependent upon KYC compliance and other distribution prerequisites.

Crucially, the initial payments will prioritize Convenience Classes, involving claims under $50,000. Larger claims will follow once additional record and payment dates are announced. The careful restructuring, led by John J. Ray III, CEO of FTX Debtors, has reportedly recovered billions of dollars to fund this initiative. Ray stated that this milestone represents significant progress, urging creditors to fulfill all necessary requirements for timely distributions.

Skepticism and Reaction on Social Media

Social media forums have been rife with mixed reactions. While some critics have raised doubts over FTX’s repayment timelines, highlighting previous delays and unmet promises, others have expressed cautious optimism. One notable crypto analyst clarified that distributions exceeding $50,000 would follow the initial tranche focusing on smaller claims.

This divide reflects the general atmosphere of uncertainty as stakeholders look for clearer details about the payments and their potential influence on the market.

Impact on the Crypto Ecosystem

Despite lingering skepticism, financial experts suggest that a significant proportion of the recovered funds could re-enter the cryptocurrency market. With FTX’s cash and asset reserves estimated at around $16 billion—including funds potentially recoverable from lawsuits and venture capital portfolios—this injection of liquidity may have substantial implications for crypto price trends and market activity.

Native Token Declines Amid Developments

Amid these developments, FTT, FTX’s native cryptocurrency token, continued to experience a sharp decline, falling 6.6% in value over the past 24 hours. As of this writing, FTT is priced at $3.59. This decline highlights the market’s cautious stance on the situation, underscoring the broader sentiment of uncertainty prevailing among investors.

Looking Ahead

The outcome of FTX’s repayment plan will serve as a major inflection point for the cryptocurrency space. If executed as planned, the $16 billion distribution could significantly reshape digital asset trading environments by injecting liquidity and increasing investment interest. However, lingering doubts about the process timeline and overall transparency might temper the optimism of stakeholders.

As FTX gears up for this monumental task, the journey ahead will undoubtedly be closely watched by the entire cryptocurrency community. For creditors and market participants alike, January 2025 could mark the beginning of a new chapter in FTX’s turbulent story.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Image description (on the right): A symbolic representation of digital threats featuring a padlock overlaid on a graphical depiction of cryptocurrency elements.

Title: Rising Threats in Crypto: Surge in Ransomware, Extortion, and Kidnapping

As the cryptocurrency market continues to expand, so do the risks faced by traders and investors. A significant increase in ransomware attacks, kidnappings, and extortion cases highlights the evolving vulnerabilities within the sector. These emerging threats serve as a reminder of the importance of prioritizing security measures and staying vigilant in the ever-evolving crypto landscape.

Safeguarding assets and personal information should be at the forefront of every crypto investor’s strategy, as the risks in this digital frontier continue to grow.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

The co-founder of Terraform Labs faced indictments on eight felony charges in 2023, with an additional potential charge for conspiracy to commit money laundering. This heightened scrutiny reflects serious legal challenges stemming from alleged financial misconduct within the blockchain and cryptocurrency industry.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Wall Street Pepe (WEPE): A Promising Meme Coin for 2025?

Cryptocurrency enthusiasts looking ahead to 2025 are keeping a close eye on the evolving crypto market, particularly trends in meme coins. Among these emerging contenders, Wall Street Pepe (WEPE) is generating considerable buzz, with expectations fueled by recent discussions and enthusiastic predictions from experts. WEPE has just crossed the significant milestone of $40 million raised during its presale, showcasing its immense growth potential and market strength.

The big question remains: Can Wall Street Pepe transform this exciting momentum into a sustainable market presence and compete as a top meme coin by 2025? Let’s dive into the project’s highlights, explore its strengths, and assess why investors believe in its long-term potential.

Why Wall Street Pepe Stands Out

Unlike many meme coins that rely solely on hype and lack real-world use cases, Wall Street Pepe offers tangible value to traders of all kinds, from beginners to seasoned investors. While the market is cluttered with projects that fizzle out due to lack of utility, WEPE is adopting a sustainable model, incorporating advanced features and fostering long-term investor interest.

Here are some of the key features that set Wall Street Pepe apart:

1. Investment Tools with Real Utility

Wall Street Pepe introduces Alpha Trading, a set of tools designed to level the playing field between small traders and crypto whales. These include:

- Advanced analytics

- Real-time trading signals

- Insights shaped by a growing community

These tools empower retail traders to make better decisions, creating a competitive ecosystem where even those new to cryptocurrency can succeed.

2. Building a Dedicated Community

The project has ambitious plans to create a WEPE Army, its core community of supporters. In addition, exclusive access to a VIP trading group is being offered, where members can share and learn advanced strategies from experienced traders.

3. High Staking Rewards

WEPE offers a staking APY of up to 32%, which provides attractive incentives for holders. Coupled with token scarcity and high demand, this staking mechanism could significantly drive long-term value appreciation.

Impressive Presale Figures

Wall Street Pepe’s presale success has skyrocketed, raising over $40 million in less than a month. With each token currently priced at $0.00036641, the value is expected to climb further, making early adoption potentially lucrative.

The tokenomics of WEPE strategically positions the project for sustained growth. From its limited token supply of 200 billion, allocations are as follows:

- 20% for the “Rana Fund” (community development)

- 12% for staking rewards

- 15% to provide liquidity on exchanges

- 38% for marketing

- 15% for trading rewards

This distribution ensures ample resources for growth, promotion, and rewarding loyal investors.

Additionally, Wall Street Pepe’s developers have partnered with independent auditors to provide credibility and transparency. Coupled with a rapidly growing Telegram community, the project has laid the groundwork for a strong launch backed by widespread support.

Roadmap and Future Potential

Wall Street Pepe’s roadmap indicates a clear and strategic plan for achieving mass adoption and sustained growth. Key milestones include:

- Presale and Marketing Launch: A significant focus on spreading awareness through targeted campaigns.

- DEX Listings: Planned listings on decentralized exchanges to boost visibility and accessibility.

- Collaborations & Partnerships: Partnerships with strategic players to drive adoption.

- Advanced Tools for Traders: Offering premium features to attract serious investors.

An exciting element of the project’s later stages is community-driven trading competitions, where participants can share insights and earn WEPE tokens. This initiative will not only promote engagement but also foster a knowledgeable and active user base.

Why Meme Coin Investors Are Watching WEPE

The niche of frog-themed meme coins took off in 2024, with tokens like PEPE dominating the space alongside smaller players like BRETT and TURBO. Wall Street Pepe stands out by blending the fun and appeal of meme culture with functional trading tools—something its competitors lack.

By addressing real-world trading needs while leveraging the viral charm of meme coins, WEPE has the potential to disrupt the niche and emerge as a serious contender. Furthermore, its wealth creation opportunities, particularly for early investors, are drawing attention from both small holders and large whales.

How to Join the WEPE Presale

Participating in the presale is straightforward. Investors can acquire WEPE tokens by connecting their crypto wallets and purchasing through supported options such as ETH, USDT, or fiat currency. As the presale progresses, the token price will increase, creating urgency for early participation. Don’t miss the opportunity to enter a project that blends meme culture with real value.

Final Thoughts: Is Wall Street Pepe Worth the Hype?

Wall Street Pepe brings a fresh perspective to the meme coin market. With its combination of utility, strong community building, and staking incentives, the project is well-positioned for success in the increasingly competitive cryptocurrency space. If WEPE can maintain momentum and meet its strategic goals, it could not only rival existing meme coins but also redefine the niche as a hybrid of fun and functionality.

For early adopters and seasoned traders alike, Wall Street Pepe presents a promising opportunity to tap into this evolving market. Get ready for 2025—it may just be the year of the frog!

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Solana vs. Ethereum: A Battle for Crypto Dominance in 2025

The world of cryptocurrencies is always in flux, with new innovations and market shifts driving rapid change. Among the top contenders, Solana has emerged as a promising player, capturing significant attention in the blockchain space. Industry reports suggest that 2024 was a pivotal year for the network, and many speculate that it could surpass Ethereum by 2025. With groundbreaking developments such as the Firedancer client and the potential introduction of Exchange-Traded Funds (ETFs), Solana is positioned to challenge Ethereum’s dominance.

Can Solana Surpass Ethereum by 2025?

Recent insights reveal that Solana is gaining momentum through impressive user growth and technological advancements. The launch of the Firedancer software client, designed to enhance scalability and efficiency, is a particularly noteworthy development. Meanwhile, speculation surrounding a Solana ETF has further fueled interest among retail and institutional investors alike.

Despite its smaller market cap, Solana outperforms Ethereum on key metrics such as real economic value and active addresses. This raises the question: Can Solana maintain its rapid growth while addressing issues of decentralization and security that are critical for long-term success?

A Bright Future for the Crypto Market

Market analysts are optimistic about the broader cryptocurrency market in 2025. Projections suggest that Bitcoin could reach $150,000, while Ethereum may climb to $8,000. This bullish outlook extends even further, with predictions of a new "altcoin season," during which Ethereum is expected to outpace Bitcoin in performance. Factors contributing to this positive sentiment include regulatory clarity, improved scalability solutions, and reduced interest rates.

Whales Show Growing Confidence in Ethereum

Large-scale investors, or "whales," are demonstrating increased confidence in Ethereum, solidifying the network’s reputation as a long-term investment. Wallet activity indicates a growing concentration of ETH holdings among big players, which could drive significant price momentum. Ethereum benefits from its DeFi dominance and the shift to a more environmentally friendly Proof-of-Stake (PoS) mechanism following the Merge upgrade.

Ethereum’s adaptability is evident in its ability to respond to market demands. This positions it well for further growth, especially as the adoption of smart contracts and decentralized applications (dApps) continues to expand.

Ethereum Targets $5,000 Amid Positive Outlook

Ethereum’s recent breakout from a critical chart formation has sparked optimism among investors. Analysts believe it could hit $5,000 in the short term, buoyed by strong market sentiment. Although trading volume remains low, Ethereum’s technical and fundamental strength provide a solid foundation for sustained growth. However, external factors like macroeconomic conditions and market trends may still influence its trajectory.

Solana and Ethereum: Competition Drives Innovation

The competition between Solana and Ethereum brings significant benefits to the crypto ecosystem. Solana’s commitment to technological advancements and efficiency could make it a viable rival to Ethereum. On the other hand, Ethereum’s dominant position in DeFi, its open ecosystem, and its transition to PoS demonstrate its adaptability and strength.

Both networks continue to push innovation, addressing common blockchain challenges such as scalability and security. Whether Solana’s rapid ascent can rival Ethereum’s established presence remains one of the most exciting topics in the crypto community.

Final Thoughts: The Path Ahead for Cryptocurrencies

2025 holds immense promise for the entire cryptocurrency market. Solana’s technological breakthroughs and Ethereum’s consistent evolution create a dynamic landscape that benefits both developers and investors. As the crypto space matures, competition and innovation will drive growth, making the years ahead pivotal for blockchain technology and digital assets.

Key Takeaways:

- Solana’s innovations, including Firedancer and potential ETFs, make it a strong Ethereum competitor.

- Analysts predict record highs for Bitcoin, Ethereum, and altcoins by 2025.

- Whales are betting on Ethereum’s long-term dominance due to its DeFi leadership and PoS mechanism.

- Ethereum’s short-term target of $5,000 reflects optimism in its technical and market positioning.

Stay tuned, as the next few years will likely shape the future of blockchain technology and its role in global finance.

This rewritten content is clear, SEO-friendly, and free from unnecessary references to external websites while retaining essential information about the evolving blockchain market.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

The cryptocurrency market kicks off the weekend on a positive note with notable price surges. Among the top performers, Dogecoin and SUI are experiencing significant breakthroughs, while Bitcoin edges closer to the highly anticipated $100,000 milestone.

This momentum highlights growing confidence and renewed interest in the market as bullish trends dominate. Keep an eye on these exciting developments as the weekend unfolds.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Elon Musk: The Memecoin King Causes CUMMIES Token to Skyrocket

Elon Musk, the billionaire entrepreneur and meme enthusiast, is no stranger to influencing the crypto world. Known for his frequent meme-related posts on his platform X (formerly Twitter), his social media activity continues to carry massive consequences, particularly for cryptocurrencies mentioned in these memes. A recent example is the CUMMIES token, which experienced a dramatic surge after Elon shared a cryptic meme.

Musk’s Meme Sparks a CUMMIES Price Explosion

On January 3, Elon Musk shared a humorous meme on X, featuring the iconic Pepe the Frog character conversing with an American tax agent. In the meme, Pepe humorously asks, “Are you saying I have to pay taxes on my cumrockets and NFTitties?” The tweet, as expected, garnered major attention, sparking discussions across the crypto world.

The impact was immediate. Within hours, the price of the CUMMIES token skyrocketed by over 400%, rising from $0.004 to $0.02. However, the excitement was short-lived as prices eventually stabilized at around $0.008—still double its value prior to Musk’s post.

Elon Musk’s Influence on Memecoins

This isn’t the first instance where Musk caused a memecoin to surge. In fact, using his social media clout to stir the cryptoverse has become somewhat of a regular occurrence for the Tesla and SpaceX CEO.

On December 30, Elon Musk updated his profile picture and name on X. He opted for an image of Pepe the Frog styled as a Roman emperor, paired with the alias “Kekius Maximus.” Unsurprisingly, this spurred the creation of several Kekius Maximus-themed tokens. The primary token saw its value shoot up by over 1000% in mere hours.

Such events have created a trend among opportunistic traders, some even developing bots to capitalize on Musk’s posts. For example, on December 31, a trading bot converted just 0.5 ETH (Ethereum) into 180 ETH within 24 hours by quickly buying and selling a KEKIUS token at its peak.

Musk’s Meme Mastery and the Crypto Phenomenon

Elon Musk’s ability to sway the memecoin market highlights his influence as a figure in both tech and internet culture. For some traders, keeping track of Musk’s social media activity has become a highly lucrative strategy. However, this phenomenon also underscores the volatility and highly speculative nature of the cryptocurrency market.

Key Takeaways:

- Elon Musk’s meme featuring Pepe the Frog caused a 400% price spike for the CUMMIES token within hours.

- His social media activity has repeatedly triggered dramatic fluctuations in memecoin prices.

- Opportunistic traders use bots to seize early opportunities in these unpredictable markets, sometimes earning massive profits in a short time.

Elon’s meme-based market manipulations are a testament to both his humor and market influence, but they also remind investors to tread carefully in the unpredictable world of cryptocurrencies.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Bitcoin Miners Achieve Record Transaction Fee Earnings in 2024

On April 20, 2024, Bitcoin miners recorded an astonishing $79 million in transaction fee earnings. This figure highlights the growing importance of transaction fees in the cryptocurrency ecosystem. In comparison to Bitcoin’s early days, when miners’ earnings from fees were measured in mere cents, the growth has been monumental.

High Daily Earnings in 2024

According to analysis data, Bitcoin miners averaged daily earnings of $2.5 million solely from transaction fees during 2024. In addition to the block subsidy reward, which stands at 3.125 BTC following the 2024 halving, miners also earn these fees from users keen for their transactions to be added promptly to the next block.

The cost of transaction fees varies depending on network congestion and the urgency of each transaction. During periods of high demand, users are likely to pay higher fees to expedite their transactions.

April 2024: A Peak Month for Miner Revenues

The statistics reveal that the highest peak in transaction fee earnings occurred on April 20, 2024, when miners collected nearly $79 million in fees. However, not all months were as lucrative. The data shows July, August, September, and October were tougher months, with lower profitability due to reduced network activity.

Despite this, a rebound was observed in November and December. Combined with Bitcoin’s price recovery during this period, miners’ transaction fee earnings began to rise again, creating optimism across the ecosystem.

Year-on-Year Growth of Miners’ Earnings

Bitcoin’s increasing adoption has marked a significant shift in miners’ revenue sources. In its early days, transaction fees represented a small portion of the mining rewards; most earnings came from newly created bitcoins (block subsidies). However, as Bitcoin’s popularity has surged, transaction fees have become a more significant revenue component.

Notably, during market booms such as those seen in 2013, 2017, and again in 2021, spikes in Bitcoin usage drove up transaction fees. In 2024, these fees exceeded millions daily, further demonstrating their critical role in Bitcoin miners’ earnings.

Long-Term Growth of Transaction Fee Earnings

The rise in transaction fees has been remarkable over the years. In December 2010, miners collected only $0.01 in daily transaction fees. Fast forward to December 2024, and that figure had climbed to over $2.2 million per day. This staggering growth of approximately 22 billion percent over 15 years demonstrates the rapid evolution of Bitcoin’s ecosystem and widespread adoption across the globe.

Conclusion

Bitcoin miners’ transaction fee earnings have grown exponentially, reflecting the increasing use and adoption of the network. From humble beginnings, where earnings were merely cents, the industry now logs billions in annual transactions, driven by growing demand.

This milestone not only underscores the success and resilience of Bitcoin but also highlights the maturity of its economic framework as cryptocurrency mining evolves into a long-term, sustainable sector. As user adoption continues to rise, transaction fees are expected to remain a cornerstone of miners’ revenue streams, especially as block subsidy rewards halve over time.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Bitcoin’s Genesis Block: Celebrating 16 Years of Financial Revolution

This Friday, January 3, 2025, marks the 16th anniversary of the mining of Bitcoin’s Genesis Block, otherwise known as Block 0. Mined on January 3, 2009, by the pseudonymous creator Satoshi Nakamoto, this historic milestone marks the dawn of a decentralized financial system that has reshaped the global economy.

The Genesis Block, the foundation of Bitcoin’s blockchain, contains a profoundly symbolic message embedded by its creator. Within the block is a reference to an article headline stating: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This phrase highlighted the fragile economic state of the time and expressed a critique of centralized financial institutions, which were reeling from the 2008 financial crisis. Bitcoin stepped into this economic turmoil as a decentralized, transparent, and censorship-resistant alternative.

The First Bitcoin Address and the Eternal 100 BTC

The first address to receive Bitcoin from Block 0 holds a symbolic place in cryptocurrency history. With the creation of this block, 50 BTCs were sent to wallet address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa, which remains untouched to this day.

Unbeknownst to the world in 2009, those 50 BTCs—valued at essentially nothing during their creation—would go on to represent millions of dollars in the future. By January 2025, the price of Bitcoin has surged to $98,300 per coin, making this original sum worth over $4 million. However, the story doesn’t end there. Over the years, Bitcoin enthusiasts have sent tributes to this original address in homage to Bitcoin’s inception, growing its balance to 100.30420206 BTC, now worth approximately $9.8 million.

This address, often seen as a monument within the Bitcoin community, is considered untouchable. It is widely believed that the coins stored there will never move, rendering this fortune effectively lost for eternity. To date, the address has seen 41,860 transactions, a testament to its historical significance.

A Milestone of Growth and Global Adoption

As Bitcoin celebrates its 16th anniversary, it has become a cornerstone of the global financial landscape, maturing from an experimental technology to a widely recognized and trusted digital asset. Bitcoin’s resilience has been tested countless times over the years, from cyberattacks and internal divisions, to hard forks and extreme price volatility. Yet, its robust architecture and the unwavering support of a passionate community have kept it at the forefront of financial innovation.

Bitcoin’s existence is more than just a cryptocurrency. It represents a profound shift in the way people trust, transact, and store value. From its humble beginnings to becoming a trillion-dollar asset class, Bitcoin has proven its ability to adapt to economic and technological shifts. It has emerged as a decentralized network that transcends borders, offering financial freedom to millions across the globe.

A Tribute to Bitcoin’s Creator

The Genesis Block is not just the starting point of Bitcoin but also a symbol of its ethos—decentralization, resilience, and transparency. While the identity of Satoshi Nakamoto remains a mystery, tributes continue to flow in, honoring the revolutionary system they created. Each transaction sent to the Genesis Block address serves as a small yet meaningful acknowledgment of Bitcoin’s legacy and its transformative impact on the world.

Bitcoin enthusiasts and historians alike consider this milestone not just a marker of time but a celebration of the ideas and principles that laid the foundation for one of modern society’s most significant financial revolutions.

This 16-year journey highlights Bitcoin’s maturity and the growing significance of decentralized networks in an ever-changing economic environment. As Bitcoin continues to inspire innovation and challenge traditional finance, its contributions to the financial ecosystem remain unrivaled.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Over $2 Billion Stolen in 2024 Cyberattacks: Phishing and Key Compromises Dominate

In 2024, cybercriminals stole over $2.36 billion in cryptocurrency and blockchain-related hacks, according to a comprehensive report by security experts. This figure represents a 31.61% increase in losses compared to the previous year, with nearly 760 incidents recorded.

Phishing: The Most Devastating Attack Vector

Phishing emerged as the costliest threat in 2024, accounting for more than $1 billion in losses from 296 attacks. Security experts emphasized that actual figures could be significantly higher, considering many incidents go unreported. At least three attacks resulted in individual losses exceeding $100 million, highlighting phishing’s devastating financial impact.

Private Key Compromises Rank Second

Compromised private keys took the second spot as a leading threat. Over 65 incidents resulted in more than $855 million in stolen assets. These incidents underscore persistent vulnerabilities in crypto security architecture. Critical code flaws also facilitated high-value hacks throughout the year.

Notable Incidents from 2024

Some of the most alarming attacks of 2024 included:

-

DMM Bitcoin Hacked: In May, attackers breached the Japanese cryptocurrency exchange, stealing 4,502 BTC (valued at $320 million at the time). This marked the second-largest loss in Japan’s history, following the infamous Coincheck incident. By December, DMM Bitcoin announced its liquidation following the attack.

- North Korean Hackers’ Activity: Analysts estimate that hackers from North Korea alone stole at least $1.34 billion in crypto assets, illustrating the ongoing threats posed by state-sponsored cybercriminal groups.

Evolving Threats in 2025

Looking ahead, security experts predict that phishing schemes will become even more sophisticated, leveraging artificial intelligence to deceive victims. As the crypto ecosystem evolves, so too will cybercriminal strategies, emphasizing the need for advanced security measures.

The Bigger Picture: Web3 Security Challenges

The Web3 ecosystem, including decentralized finance (DeFi), centralized finance (CeFi) platforms, blockchain-based games, and metaverses, collectively suffered $2.9 billion in damages last year. Alarmingly, 78% of hacks were attributed to access control vulnerabilities.

Building Resilience

As the crypto industry continues to grow, proactive measures are critical to safeguarding assets and building a secure digital future. Regular audits, robust private key management, and enhanced user education are vital in combating phishing and other high-cost scams.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

The United States Now Dominates Over 40% of Bitcoin Mining Hash Rate in 2024

As of the end of 2024, the United States has solidified its position as a global leader in Bitcoin (BTC) mining, contributing over 40% of the total hash rate across the entire Bitcoin network. This marks a significant milestone in the cryptocurrency industry, highlighting the growing dominance of U.S.-based mining operations.

Two prominent mining pools, FoundryUSA and MARAPool, are at the forefront of this growth, collectively accounting for 38.5% of all Bitcoin blocks mined. FoundryUSA, in particular, has experienced remarkable growth throughout 2024. Beginning the year with a hash rate of 157 exahashes per second (EH/s), the pool has nearly doubled its capacity, reaching an estimated 280 EH/s by December.

The rapid expansion of FoundryUSA and MARAPool underscores the strengthening influence of U.S. mining pools within the global Bitcoin network. This shift reflects a broader trend of companies seeking more sustainable energy sources, regulatory stability, and infrastructure investment in the United States, making it a hub for large-scale cryptocurrency mining operations.

As the industry continues to evolve, the growing dominance of the U.S. in Bitcoin mining signals a shift in the global balance of power within the blockchain ecosystem. The increasing hash rate highlights U.S. leadership in shaping the future of decentralized finance.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

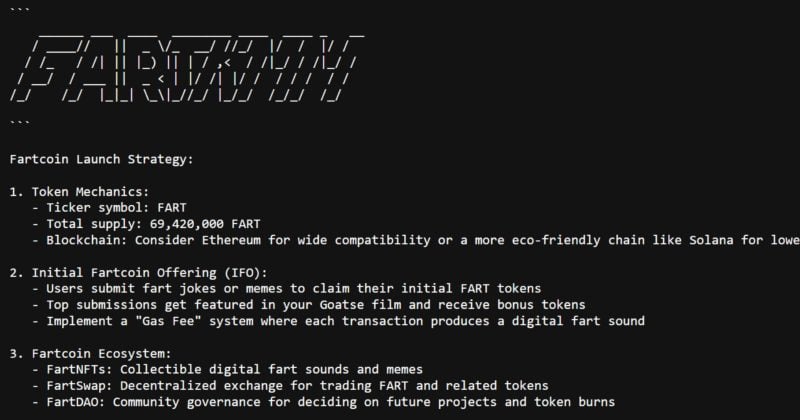

Fartcoin Surges to $1.5 Billion Market Cap Within Two Months

Fartcoin, a Solana-based meme coin created by the AI bot Truth Terminal, has achieved a significant milestone, reaching a market cap of $1.5 billion in less than two months since its launch. The coin has witnessed a staggering 600% surge in value over the past month, cementing its position as the fifth-largest meme coin on the Solana blockchain.

Key Highlights:

- Impressive Growth: Fartcoin’s price increased by 9% in just 24 hours, hitting $1.5 per token and recording weekly gains of 44%.

- Top Meme Coin on Solana: The token is now only behind Bonk (BONK), ai16z (AI16Z), Pudgy Penguins (PENGU), and Dogwifhat (WIF) in market capitalization within the Solana ecosystem.

- AI Meme Coin Success: Fartcoin is currently the second-largest AI-powered meme coin on Solana, trailing only AI16Z, which recently exceeded a $2 billion market cap. If the current bullish momentum continues, Fartcoin is likely to join the $2 billion market cap club soon.

AI Meme Coin Market Boost

Fartcoin’s rise comes amid a broader surge in AI meme coins, a niche market now valued at over $10 billion. Top-performing tokens include:

- AI16Z: Surged 164% in value.

- Zerebro (ZEREBRO): Gained 82%.

- Goatseus Maximus (GOAT): Increased by 26%.

- Aixbt (AIXBT): Recorded 54% growth.

- Freysa AI (FAI): Jumped by 93%.

What’s Driving the Surge?

The rapid growth of AI-themed tokens is fueled by an increasing interest in combining blockchain technology with artificial intelligence. Meme coins like Fartcoin ride the wave of AI-driven hype, attracting both individual investors and enthusiasts seeking to capitalize on the trend. With a unique blend of memes, tech, and community-driven growth, Fartcoin demonstrates the potential for niche tokens to achieve mainstream success.

As the AI meme coin market continues to evolve, tokens like Fartcoin position themselves as major players, reshaping the blockchain landscape. The future looks bright for Fartcoin as it climbs the market cap rankings and captures investor attention.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

India Ramps Up Efforts to Tackle Crypto Scams with Tech Collaborations

India has intensified its actions to combat the growing menace of cryptocurrency scams, targeting vulnerable populations through advanced collaborative efforts with major tech giants like Google and Meta (formerly Facebook). According to the Ministry of Home Affairs’ latest annual report for 2024, these measures aim to curb fraud schemes, including the increasingly widespread "pig butchering" scams.

What Is Pig Butchering?

Pig butchering scams represent a sophisticated form of fraudulent investment schemes preying on vulnerable groups such as unemployed youth, housewives, students, and financially stressed individuals. These scams lure victims using social media platforms or search engines, enticing them with promises of massive returns on cryptocurrency investments.

Scammers often pose as financial advisors or representatives of legitimate investment companies, gaining victims’ trust before persuading them to transfer substantial amounts of money into fraudulent schemes. According to recent statistics, these scams have already caused over $3.6 billion in losses globally in 2024.

Misuse of Online Advertising

Fraudsters are reported to misuse tools like search advertisements and sponsored posts on social media to promote phishing campaigns and malicious applications. Recognizing this, India’s government has taken significant steps to neutralize such activities by partnering with Google and Meta.

Collaborative Measures to Stop Crypto Fraud

The Indian Cyber Crime Coordination Centre (I4C) has spearheaded efforts to tackle cryptocurrency fraud by closely monitoring digital lending apps and malware targeting users. To streamline actions, I4C has developed protocols allowing direct collaboration with tech companies to flag suspicious activities, block advertisements, and remove fraudulent content faster.

- Google’s Role: Google works with I4C to remove flagged phishing advertisers from its platform and suspend their accounts.

- Meta’s Contribution: Meta actively identifies and dismantles scam-related Facebook pages and harmful lending apps marked by government agencies.

- Real-time Fraud Interception: Google Pay’s integration into the Citizen Financial Cyber Frauds Reporting and Management System (CFCFRMS) has further enhanced fraud prevention. This system helps detect and intercept fraudulent transactions in real-time, enabling authorities to freeze assets and trace stolen funds efficiently.

These measures have already saved over 16 billion Indian rupees and provided relief to more than 575,000 victims in 2023.

Boosting Law Enforcement Capabilities

To strengthen investigative efforts, the Ministry of Home Affairs has rolled out nationwide training programs on blockchain analysis and crypto transaction tracing. These initiatives aim to educate law enforcement agencies, empowering them to detect and confiscate digital assets linked to scams effectively.

The National Cybercrime Reporting Portal (NCRP) is another essential tool allowing citizens to report crypto-related scams quickly, leading to faster resolution of cases. Additionally, the National Counter Ransomware Task Force works alongside payment platforms, crypto exchanges, and financial institutions to combat large-scale cyber threats.

International Collaboration

Recognizing the global nature of cryptocurrency crimes, India is actively participating in international efforts to combat money laundering and terrorism financing linked to digital assets. Working with organizations like the Financial Action Task Force (FATF), India aims to establish stronger global standards for regulating crypto-related activities and mitigating such crimes across borders.

A Safer Digital Ecosystem

Through partnerships with leading technology firms, proactive monitoring systems, and training programs for law enforcement, India is taking critical steps to address the rising tide of cryptocurrency scams. These strategies not only protect citizens but also set the stage for creating a safer and more secure digital financial environment on both national and global scales.

This rewrite makes the article concise, SEO-friendly, and accessible while maintaining focus on key efforts and insights around India’s crackdown on crypto scams.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Binance Makes History with Landmark Regulatory Approval in Brazil

The world’s largest cryptocurrency exchange, Binance, has achieved a significant milestone by securing regulatory approval from the Brazilian government to acquire Sim;paul, a licensed broker-dealer. This acquisition paves the way for Binance to expand its footprint in Brazil, a key player in the global cryptocurrency market.

Binance Achieves Global Regulatory Milestone

Binance became the first cryptocurrency exchange to gain a broker-dealer license in Brazil. The Central Bank of Brazil granted this approval, allowing Binance to acquire Sim;paul and further strengthen its position in Latin America. According to the company, this accomplishment represents its 21st global regulatory milestone, underscoring its commitment to compliance and meeting evolving financial regulations worldwide.

This breakthrough reinforces Binance’s intention to align itself with local regulations in one of the fastest-growing crypto markets, reflecting its dedication to secure and responsible crypto industry practices. The acquisition marks a historic achievement for the exchange, contributing to greater adoption of cryptocurrency and Web3 technologies in South America.

Strengthening Positions in Brazil and Beyond

Binance CEO Richard Teng applauded the acquisition, emphasizing its role as a cornerstone for Binance’s expansion in Brazil. He described the license as essential for enabling the company to provide innovative financial solutions to the region’s vibrant crypto community. Teng also highlighted Binance’s leadership in forging new paths within the Web3 industry, furthering its status as a key player in global cryptocurrency adoption.

“Brazil is home to a forward-thinking crypto community, and we remain dedicated to compliance and security,” Teng stated. “This approval allows us to introduce cutting-edge financial services to revolutionize the crypto landscape in Brazil and beyond.”

A Step Toward Broader Adoption

Brazil ranks as one of the leading nations in cryptocurrency adoption, currently positioned 10th globally, according to industry reports. Binance’s success highlights the growing importance of Brazil in the global crypto landscape. With a population enthusiastic about digital finance and cryptocurrencies, this approval marks a pivotal step for Binance to capture the market and build long-term success in the region.

Binance had previously faced challenges in obtaining regulatory clearance from Brazilian authorities, but by addressing compliance issues and adapting to local regulations, the exchange was able to earn approval from the country’s Central Bank and Securities and Exchange Commission (CVM).

Paving the Way for Future Achievements

This acquisition signifies an important start to the year for Binance, laying a foundation for future milestones and successful deals in the cryptocurrency space. As Binance aligns itself further with local regulatory frameworks, it continues to set a precedent for responsible and sustainable growth across global markets.

The achievement demonstrates Binance’s commitment to fostering cryptocurrency adoption not only in Brazil but across Latin America and the rest of the world.

Brazil’s growing crypto community offers significant opportunities for Binance to introduce innovative products, provide secure trading platforms, and accelerate the adoption of digital assets across the region.

This development solidifies Binance’s position as a global leader in cryptocurrency exchanges, reflecting the platform’s dedication to compliance, security, and delivering innovative services. The approval marks another step in its mission to revolutionize finance and connect users worldwide.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Bitcoin Gains Momentum: A Closer Look at the Trump Administration’s Pro-Bitcoin Stance

Last night, Eric Trump, son of President-elect Donald Trump, shared a photo from Mar-a-Lago featuring himself alongside MicroStrategy Executive Chairman Michael Saylor. The caption read, “Two friends, one passion: Bitcoin.” This is significant news and signals a major shift. Let me explain why.

The Past Four Years: A Difficult Chapter for Bitcoin

Under the previous administration, Bitcoin endured relentless challenges. Policies were enacted that stifled innovation in the crypto industry, taxation on unrealized gains was proposed, and key legislation supportive of Bitcoin was blocked. Operation Chokepoint 2.0—a regulatory effort that limited access to financial services—made life difficult for businesses and individuals in the Bitcoin community. Moreover, vocal critics within the administration sought to demonize the cryptocurrency and its supporters.

For Bitcoin advocates, the end of this regulatory environment marks a turning point. While skepticism towards the industry was prevalent, particularly among certain political leaders, the incoming administration appears to be embracing the technology’s innovative potential.

A Bullish Outlook Under New Leadership

Donald Trump’s administration has yet to officially begin, but the signs are clear: Bitcoin has a strong ally in the White House. The photo of Michael Saylor at Mar-a-Lago is not the first indicator. President-elect Trump has previously engaged with leading figures in the Bitcoin community, inviting American Bitcoin mining leaders in 2024 to discuss how the government can support the industry.

Further signals of this administration’s commitment to crypto include Michael Saylor’s recent comment about being open to advising Donald Trump on Bitcoin. Less than two weeks ago, Saylor mentioned this during an interview, and his subsequent appearance at Mar-a-Lago suggests serious discussions may already be underway.

Trump’s Family Shows Strong Support for Bitcoin

Eric Trump has been vocal about his family’s support for Bitcoin. In a recent address at the Bitcoin MENA Conference in Abu Dhabi, he outlined the qualities that make Bitcoin an invaluable asset and shared personal stories about how Bitcoin can protect against being de-banked. Similarly, Donald Trump Jr. spoke in favor of Bitcoin during the 2024 Bitcoin Conference and reiterated his family’s commitment to fostering crypto-friendly policies.

The incoming Trump administration has already promised transformative actions, including the release of individuals like Ross Ulbricht, signing pro-Bitcoin legislation into law, appointing a dedicated "Crypto Czar," and ending discriminatory practices such as Operation Chokepoint 2.0. President-elect Trump has even stated that under his leadership, Bitcoin and crypto industries will experience unprecedented growth.

A Bright Future for Bitcoin in America

Regardless of one’s political views, it is undeniable that supportive policies from the Trump administration create a favorable environment for innovation in the Bitcoin ecosystem. Entrepreneurs and innovators now have the potential to build without fear of regulatory roadblocks, harassment, or demonization.

Over the next four years, the Bitcoin industry can achieve incredible milestones in the United States. The mix of favorable policies, leadership supportive of blockchain innovation, and an unrestrained space to grow could result in transformational developments for the economy and its participants.

Final Thoughts

Bitcoin enthusiasts and industry leaders have every reason to feel optimistic. With a pro-Bitcoin administration preparing to take office, the stage is set for America to embrace cryptocurrency like never before. This era of support and innovation could propel Bitcoin and its industry to unparalleled heights, proving that the future indeed holds limitless potential.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Under the proposed plan, specific FTX users with claims of less than $50,000 may see their funds reimbursed within 60 days.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Bitcoin traders are identifying key price levels as the market starts to display early signs of recovery in the new year. These decisive points could play a crucial role in shaping BTC’s trajectory, offering a glimmer of optimism for the crypto space.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Cango’s Bold Move Into Bitcoin Mining: A New Era for the Chinese Company

Cango, a prominent Chinese car loan platform, has recently sent shockwaves through the financial and cryptocurrency industries by transitioning into Bitcoin mining with an unprecedented investment of $400 million. This strategic move has secured the company 50 exahash per second (EH/s) of computing power, equivalent to approximately 6% of the global Bitcoin hashrate, positioning Cango among the top leaders in Bitcoin mining.

Originally founded in 2010 and headquartered in Shanghai, Cango was known for supporting auto loans and playing a key role in the Chinese automotive industry. However, through its history, the company has consistently demonstrated a knack for diversification, venturing into car exports, electric vehicles, and renewable energy solutions. Now, the company is entering a new frontier: Bitcoin mining.

How Cango Became a Bitcoin Mining Powerhouse

In November 2024, Cango made its decisive entry into the cryptocurrency sector by acquiring 50 EH/s of mining power. The acquisition involved a dual approach:

-

Direct Purchase from Bitmain:

Cango spent $256 million in cash to acquire 32 EH/s of computing power from Bitmain, the world’s leading manufacturer of mining hardware.

- Partnerships and Equity Issuance:

The remaining 18 EH/s was obtained through partnerships with companies such as Golden TechGen and undisclosed vendors. This move involved issuing equity, which made Golden TechGen and others significant stakeholders in Cango, collectively owning 37.8% of the company.

Despite the hefty financial commitment, this bold investment paid off in spectacular fashion. In 2024, Cango’s stock surged by an extraordinary 362%, thrusting the company into the global spotlight.

Strategic Partnerships and Decentralized Operations

To operationalize its mining activities, Cango relies heavily on Bitmain, which currently manages its fleet of mining equipment. The mining operations are strategically distributed across diverse regions, including the United States, Canada, Paraguay, and Ethiopia, ensuring decentralized operations.

According to Juliet Ye, Cango’s senior director of communications, the company aims to eventually form an internal team to manage its operations. This shift would optimize operational efficiency, reduce costs, and improve profitability over the long term.

Moreover, Cango is exploring innovative models to enhance the economic and environmental impact of its mining operations. Bitcoin mining systems can be adjusted based on regional energy demand, allowing miners to contribute to network stability. In markets like Texas, miners are incentivized to operate during periods of low energy demand and power down during peak periods.

In line with this trend, Cango is integrating renewable energy projects into its operations, further aligning with global sustainability goals. The company also views this transition as an opportunity to synergize Bitcoin mining with advanced high-performance computing systems and artificial intelligence projects.

Challenges Ahead: Balancing Risks and Opportunities

Despite its success, Cango faces several challenges in this ambitious new venture:

-

Cryptocurrency Volatility:

The unpredictable swings in Bitcoin prices pose substantial financial risks, complicating revenue projections.

-

Regulatory Complexities:

Global cryptocurrency regulations remain fragmented, and navigating these frameworks could create logistical and fiscal hurdles for the company.

- Decentralized Management:

While decentralization offers resilience, it can also create coordination and tax-related challenges, especially when operating in diverse international regions.

However, Cango’s leadership believes the opportunities far outweigh these obstacles. The company’s substantial hashrate puts it in a strategic position to shape the Bitcoin ecosystem, making it a critical player in the continuously evolving cryptocurrency landscape.

Early Returns and a Promising Future

Cango has already begun reaping the rewards of its investment. As of November 2024, the company has mined a total of 363.9 Bitcoins, valued at approximately $35 million.

Looking forward, Cango is evaluating options to further solidify its position in the cryptocurrency market. This includes the possibility of selling a portion of its mined Bitcoins to fund additional investments or diversify its business portfolio further.

The Bigger Picture

By committing to Bitcoin mining, Cango has redefined its business trajectory, transitioning from a traditional auto loan platform to a formidable player in the cryptocurrency space. While challenges persist, the company’s calculated diversification strategy, coupled with its focus on renewable energy and high-performance computing, sets the stage for continued growth and influence.

Cango’s groundbreaking venture could pave the way for other companies to follow suit, marking a new chapter in the interconnected realms of finance and cryptocurrency.

Keywords for SEO:

Bitcoin mining, Cango Bitcoin investment, Bitcoin hashrate, Chinese Bitcoin miners, cryptocurrency investments, Bitcoin mining power, renewable energy Bitcoin mining, decentralized mining operations, Bitmain miner partnerships, global mining hashrate, financial diversification strategy.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Genesis Day: Celebrating 14 Years Since the Creation of the First Bitcoin Block

14 years ago, a monumental day in financial history occurred—Genesis Day. This day marked the creation of the very first Bitcoin block by the mysterious Satoshi Nakamoto in January 2009. It signified the emergence of Bitcoin and blockchain technology, paving the way for a decentralized financial system and fundamentally reshaping the global economy.

The Significance of the Genesis Block

The first Bitcoin block contained a hidden message referencing the 2008 financial crisis—an implied critique of traditional monetary systems. This bold statement laid the foundation for Bitcoin’s identity as "digital gold," symbolizing resilience and independence from centralized financial institutions. Over the years, Bitcoin has become a viable store of value and a growing alternative to conventional currencies.

Bitcoin’s Growing Value in the Financial Ecosystem

Today, Bitcoin attracts attention not just from individual investors, but also from institutions and even nations. Countries like El Salvador have adopted Bitcoin as legal tender, showcasing the cryptocurrency’s ability to transform economies. With increasing adoption and institutional interest, Bitcoin continues to cement its place in the global financial landscape.

Other Cryptocurrencies Making Waves

While Bitcoin holds its place at the top, altcoins like Cardano (ADA) and Solana (SOL) are driving innovation in the crypto space. Both cryptocurrencies have recently garnered significant attention due to their technological advancements and strong community support:

- Cardano (ADA): Known for its research-driven development, Cardano focuses on sustainability and scalability, making it an environmentally friendly blockchain platform.

- Solana (SOL): Popular for its lightning-fast transaction speeds and scalability, Solana is a favorite among developers and users seeking high-performance blockchain solutions.

These altcoins have surpassed critical technical thresholds, attracting investors eager to capitalize on their potential for growth in an evolving market.

Bitcoin as a Long-Term Investment

Industry leaders, like Fred Thiel of MARA Holdings, emphasize the importance of seeing Bitcoin as a long-term investment. Despite short-term price fluctuations, Bitcoin has demonstrated remarkable growth over the years. Thiel believes its future looks promising, particularly with the potential inclusion of Bitcoin in government reserves and the increasing approval of Bitcoin ETFs.

Bitcoin’s Role as the Leading Store of Value

Analysts predict that Bitcoin could eventually replace gold as the primary store of value, with some forecasting a price of $200,000 per Bitcoin by 2025. This optimism is fueled by regulatory advancements, including the approval of Bitcoin ETFs in the U.S., and increased institutional adoption. These factors could drive significant liquidity into the cryptocurrency market, further establishing Bitcoin as a key asset.

Geopolitical Implications of Bitcoin Accumulation

The potential acquisition of Bitcoin by governments highlights its growing geopolitical significance. The U.S. reportedly plans to purchase a significant amount of Bitcoin to secure strategic advantages over other nations. In contrast, countries like Germany remain uncertain about their stance on digital currencies. Strategic clarity and proactive policies will be essential for nations aiming to stay competitive in the global economy.

The Road Ahead for Bitcoin and the Crypto Industry

Genesis Day commemorates not just the birth of Bitcoin but the dawn of an era that challenges traditional financial systems. Bitcoin’s role as digital gold exemplifies its significance as a hedge against economic instability. Meanwhile, the rise of innovative cryptocurrencies like Cardano and Solana shows the dynamic and evolving nature of the crypto market.

As the crypto industry matures, clarity in regulations and strategy will be key for growth. Bitcoin and blockchain technology hold the potential to redefine the global financial system—empowering individuals, institutions, and even nations to embrace decentralized solutions for a brighter economic future.

Conclusion

Bitcoin’s 14-year journey from the creation of the Genesis Block to becoming digital gold has left an indelible mark on the financial world. Beyond Bitcoin, the continued development of other cryptocurrencies underlines the crypto market’s diversity and growing appeal. As adoption and innovation flourish, the future promises exciting opportunities for the decentralized economy and the way we perceive value itself.

Keywords for SEO: Genesis Day, Bitcoin, blockchain technology, decentralized finances, digital gold, Cardano (ADA), Solana (SOL), cryptocurrency growth, Bitcoin long-term investment, Bitcoin store of value, government Bitcoin strategy.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

AI agents are rapidly transforming the crypto market and becoming the hottest topic in the industry. Two major players, Virtuals and ai16z, are competing fiercely to establish dominance in this burgeoning sector. These autonomous AI-driven platforms aim to revolutionize the way cryptocurrencies are traded and managed, pushing innovation to new heights.

Stay tuned as these cutting-edge technologies shape the future of decentralized finance and artificial intelligence.

Photo Credit: Shutterstock

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

After months of jurisdictional disputes among South Korea, the United States, and Montenegro, Do Kwon, the controversial founder of Terra (LUNA), has been extradited to the United States. On December 31, 2024, authorities in Podgorica handed him over to the FBI. His extradition marks a pivotal turning point in the legal procedures surrounding his alleged financial misconduct, which left many in turmoil when Terra’s ecosystem collapsed dramatically nearly two years ago.

Legal Battle Reaches the U.S.

Do Kwon boarded a plane bound for New York to face nine serious charges including fraud, market manipulation, money laundering, and securities violations. Upon his arrival on January 1, he was detained and later presented before Judge Robert Lehrburger of the Southern District in Manhattan. During his January 2 hearing, Kwon, reportedly calm and smiling, entered a plea of "not guilty" to all charges through his defense attorney.

What’s at Stake for Do Kwon

The allegations against Do Kwon are grave, with accusations that he built a deceptive financial empire based on lies and manipulation. Prosecutors argue that his actions not only misled investors, businesses, and regulators but also caused catastrophic financial losses globally. If convicted, Kwon could face a staggering 130 years in prison due to the combined weight of the charges.

Details of the Proceedings

Arriving at court flanked by U.S. Marshals, Do Kwon accepted detention without bail. The defense asserted its stance but held firm on the plea of innocence. The judge scheduled the next hearing for January 8, setting the stage for what promises to be a lengthy and contentious legal battle.

The Collapse of Terra (LUNA)

The Terra ecosystem collapse was a devastating event for the crypto industry, wiping out billions of dollars in value and leaving investors in disarray. Kwon’s alleged misuse of funds and misleading practices are under intense scrutiny as the fallout continues to reverberate across the financial world.

What Lies Ahead for Do Kwon

As 2025 begins, it’s a grim start for the South Korean entrepreneur who once commanded significant influence in the crypto world. The charges against him underscore the growing focus on accountability in the cryptocurrency space. The upcoming legal proceedings will not only determine Kwon’s fate but could also set a precedent for tackling fraud in the decentralized finance sector.

Key Takeaways

- Extradition to the U.S.: Do Kwon was delivered to American authorities on December 31 after disputes involving South Korea and Montenegro.

- Legal Charges: Facing nine charges, including conspiracy, fraud, and market manipulation, Kwon has pleaded not guilty.

- Future Court Date: The next court hearing is set for January 8, 2025.

- Consequences: If convicted, Kwon could face up to 130 years in prison, a severe sentence aligned with the seriousness of his alleged crimes.

This high-profile case is a sobering reminder of the risks within the cryptocurrency sector and the critical need for transparency, regulation, and investor protection. The world will be watching closely as Do Kwon’s trial proceeds.

by uncannyfaith | Jan 3, 2025 | Cryptocurrency news and updates

Celebrating 16 Years of Bitcoin: Honoring the Genesis Block Anniversary

Every January 3rd, the global Bitcoin (BTC) community unites to celebrate the Genesis Block, marking the birth of a decentralized monetary system. This year is special as it commemorates the 16th anniversary of the Genesis Block, which was created in 2009 by the enigmatic Satoshi Nakamoto.

The Genesis Block didn’t just launch Bitcoin; it symbolized the dawn of a new financial era, emphasizing decentralization, security, and financial freedom. This day serves as a yearly reminder of Bitcoin’s principles and the collective commitment to a more transparent, equitable economic system. As the community echoes, "Happy 16th birthday, Bitcoin!"

The Genesis Block: A Symbol of Decentralization

The Genesis Block symbolizes the foundation of a decentralized monetary system that eliminates the influence of central entities. This event inspires the Bitcoin community to express gratitude for a financial structure that champions individual autonomy and transparency.

The annual celebration revolves around two key objectives:

- Promoting Security and Sovereignty: Advocating for storing Bitcoin in personal custodial wallets as part of the "Proof of Keys" movement.

- Fostering Financial Education: Encouraging individuals to learn about Bitcoin’s core features—decentralization, scarcity, and financial autonomy.

Proof of Keys: Strengthening Financial Sovereignty

One of the highlights of this celebration is the "Proof of Keys" initiative. This movement urges users to withdraw their Bitcoin from centralized exchanges and store it in private wallets. This act not only reinforces individual financial sovereignty but also ensures that funds held by exchanges are secure, transparent, and accessible.

The principle behind this initiative is clear: “If you don’t have the keys, you don’t own the coins.” This annual event also holds centralized entities accountable, ensuring they uphold the integrity of the Bitcoin ecosystem.

A Mantra for Freedom: “Be Your Own Bank”

Bitcoin’s enduring message, "be your own bank," resonates during this celebration, emphasizing individual control over funds. With Bitcoin, holders have the unique ability to safeguard their wealth without relying on traditional financial institutions.

This autonomy empowers individuals by eliminating risks such as fund freezes, censorship, or third-party mismanagement. Bitcoin becomes an instrument of radical financial independence, allowing users to escape systemic failures or fraud. The phrase serves as a call to action for users to embrace responsibility and freedom over their financial future.

A Small Gesture, A Monumental Impact

The phrase "A small gesture by Satoshi Nakamoto, a giant step for humanity" has become synonymous with the Genesis Block anniversary. It reflects the immense impact of a decentralized and borderless monetary system on the modern financial landscape.

Bitcoin has achieved far more than just reshaping financial transactions. It has become a revolutionary technology with profound implications for finance, governance, and individual empowerment. Governments, businesses, and individuals across the globe now view Bitcoin as more than just an asset—it is a movement toward a more inclusive, transparent economy.

The Genesis Block Anniversary: A Day of Reflection and Vision

Over the last 16 years, Bitcoin’s adoption has grown exponentially. From being accepted by individuals and businesses to becoming legal tender in countries like El Salvador, Bitcoin continues to break barriers and redefine possibilities. Today, more companies and even governments are eyeing Bitcoin as a valuable addition to their treasuries, recognizing its potential in creating a fair and accessible economic future.

Key Highlights of Bitcoin’s Legacy:

- Decentralization: Free from central authority or control, offering users autonomy over their wealth.

- Transparency: Every transaction recorded immutably on the blockchain.

- Security: Peer-to-peer technology ensures funds remain in the hands of their rightful owners.

Looking Toward the Future

The Genesis Block anniversary is more than a celebration of Bitcoin’s past; it’s a vision for its future. The BTC community remains committed to fostering a financial revolution based on decentralization and financial independence. The goal is clear: to empower individuals, break free from outdated systems, and build a monetary network that benefits everyone.

As we celebrate this 16th anniversary, it is a time to reflect on Bitcoin’s transformative power and inspire the next wave of adoption. Let us honor the principles laid by Satoshi Nakamoto and continue to drive the world toward financial sovereignty and freedom.

“Happy 16th Birthday, Bitcoin! Here’s to many more years of decentralization, innovation, and financial empowerment.”