by uncannyfaith | Oct 19, 2025 | Cryptocurrency news and updates

Li Lin, the founding father of a significant cryptocurrency change and the present president of Avenir Capital, has reportedly raised roughly $1 billion to fund a large-scale funding technique centered on Ethereum (ETH).

In keeping with current studies, Li has joined forces with outstanding figures within the crypto trade, together with Shen Bo (co-founder of Fenbushi Capital), Xiao Feng (CEO of HashKey Group), and Cai Wensheng (founding father of Meitu). The group goals to launch an modern Ether accumulation technique via a Nasdaq-listed shell firm. The initiative has already secured appreciable backing — $500 million from HongShan Capital Group and $200 million from Li’s personal agency, Avenir Capital.

Sources near the venture say the group intends to formally launch the Ethereum-focused belief inside two to a few weeks, bolstered by sturdy help from the ETH investor neighborhood.

Li Lin initially based the cryptocurrency change in 2013, later promoting it to well-known crypto determine Justin Solar. Following the acquisition, disputes between the 2 events escalated into lawsuits, primarily over using the corporate’s authentic identify and allegations of fraudulent conduct.

On the time of writing, knowledge reveals that the value of Ethereum has risen to $3,857 — reflecting a 9% improve over the previous seven days — signaling bullish investor sentiment within the broader market.

Avenir Capital stays a big participant within the digital asset funding area. As of August, the agency reported holding over 16.5 million shares in a outstanding Bitcoin exchange-traded fund. Avenir has additionally diversified into different tokens corresponding to Ethereum and Solana (SOL). In September, the corporate participated within the launch of Solana’s $500 million ecosystem treasury, additional increasing its affect throughout the crypto sector.

This strategic pivot by main buyers underscores a rising shift towards long-term cryptocurrency accumulation fashions and is more likely to have lasting impacts on future digital asset funding traits.

Key Takeaways:

– Li Lin has raised $1 billion to spend money on Ethereum by way of a Nasdaq-listed entity.

– The initiative has backing from main gamers, together with HongShan Capital and Avenir Capital.

– Ethereum’s market worth not too long ago rose to $3,857, reflecting sturdy investor curiosity.

– Avenir stays a key institutional holder of each Bitcoin and Solana.

Tags: Ethereum funding | Crypto technique | Avenir Capital | Li Lin | ETH value | Institutional crypto funding | Solana | Bitcoin ETF holdings

by uncannyfaith | Sep 29, 2025 | Cryptocurrency news and updates

Positive! Here is a rewritten, Website positioning-optimized, and extra readable model of the offered content material, stripped of references to particular web site names and formatted for readability:

—

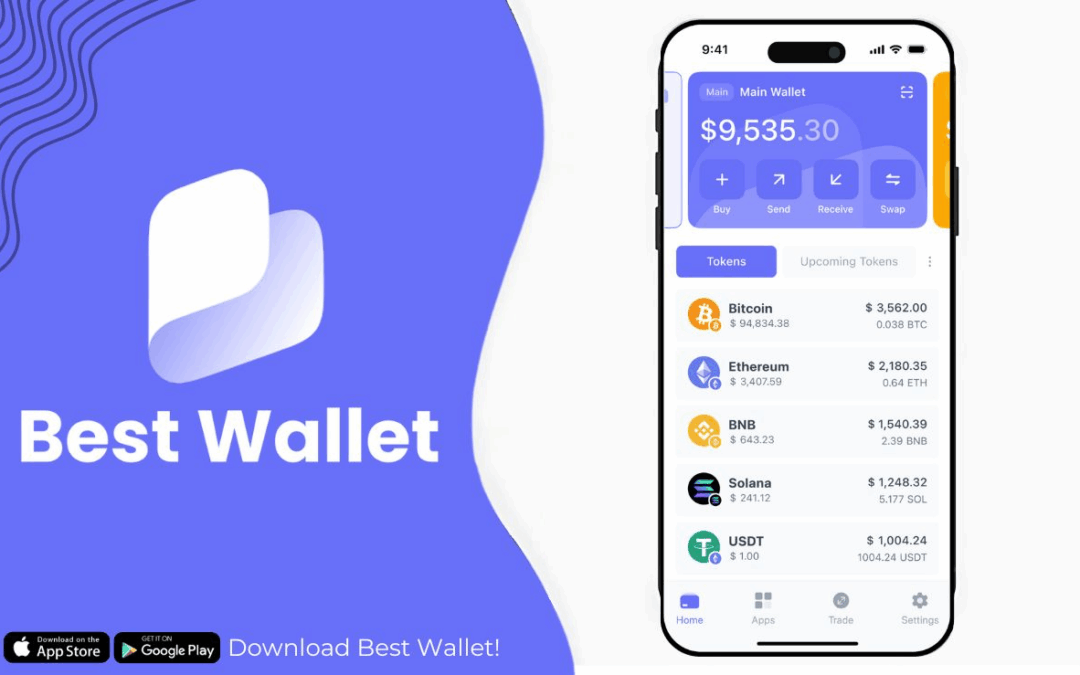

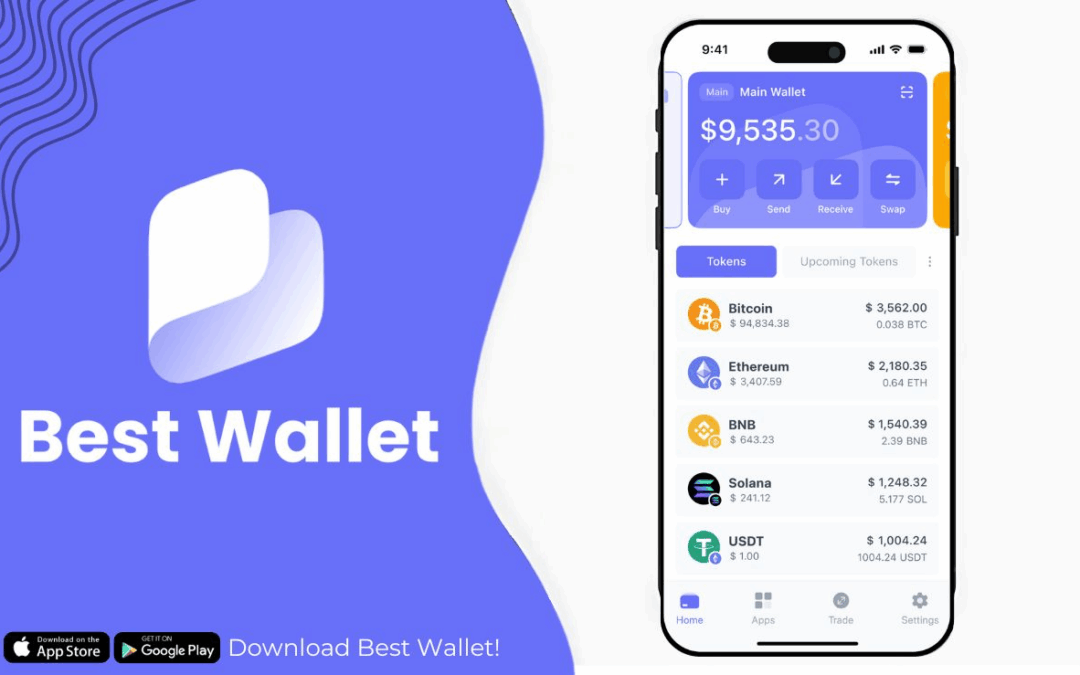

# Finest Pockets: The Main Non-Custodial Crypto Ecosystem to Watch

Over current months, the demand for safe and versatile non-custodial crypto options has grown considerably. In response, progressive platforms have emerged to satisfy consumer wants—amongst them, Finest Pockets stands out.

## What Is Finest Pockets?

Finest Pockets is a cutting-edge, non-custodial Web3 crypto pockets designed to function throughout a number of blockchain networks. It presents customers entry to a various vary of cryptocurrencies with out the necessity for KYC (Know Your Buyer) verification. This makes it a privacy-first resolution, ultimate for customers looking for full management over their belongings.

Key advantages embrace:

– Multi-chain compatibility

– Consumer-friendly design

– No want for id verification (non-custodial)

– Entry to a big and diversified record of cryptocurrencies

Moreover, Finest Pockets includes a robust and rising group, pushed partially by the presale of its native token, BEST—a promising crypto asset providing main potential for early buyers.

## Finest Pockets: Options & Advantages

Because the crypto ecosystem matures, decentralized finance (DeFi) options like Finest Pockets have develop into more and more vital. Builders are targeted on creating safe, scalable, and decentralized alternate options to centralized exchanges.

What makes Finest Pockets totally different?

– 🌐 Multi-chain Ecosystem: Assist for layers past Ethereum, permitting customers to discover alternatives throughout numerous blockchains.

– 🔍 Suspicious Token Filter: A built-in safety layer that helps determine probably fraudulent tokens.

– 🚀 Upcoming Tokens Part: Acquire early entry to new and promising crypto initiatives.

– 📲 Cell-Optimized Interface: Designed for seamless use on smartphones and tablets.

– 💱 Cross-Chain Swaps: Simply commerce belongings throughout totally different networks.

These options make the platform extremely accessible—even for newbies—whereas providing depth and highly effective instruments for skilled crypto buyers.

## Why the BEST Token Presale is Producing Buzz

Fueling the thrill round Finest Pockets is the continued presale of its native utility and governance token, BEST.

Advantages of holding BEST:

– Reductions on transaction charges

– Staking rewards for passive earnings

– Governance participation for future platform selections

Up to now, the presale has raised over $16 million—a robust indicator of rising curiosity. With a low entry worth, the BEST token presents a novel alternative for buyers earlier than its official market launch.

## Professionals and Cons of Finest Pockets

No product is ideal. Here is a fast overview of the benefits and potential drawbacks of utilizing Finest Pockets:

| Professionals | Cons |

|———————————————————————-|————————————————————–|

| Free entry to a diversified crypto ecosystem | Some options might not be instantly intuitive for newbies |

| Optimized for cellular utilization | |

| Helps cross-chain swaps and operates on a multi-chain community | |

| Presents early entry to newly listed and rising tokens | |

| Alternative to put money into a promising native token (BEST) | |

Total, Finest Pockets presents one of the crucial complete and decentralized pockets experiences at present accessible on the DeFi market.

## Closing Ideas

With elevated consideration from influencers and crypto lovers, Finest Pockets is quickly turning into a top-tier non-custodial resolution within the digital asset area. Whether or not you are a newcomer or a seasoned investor, this platform gives the instruments and safety wanted to navigate the evolving blockchain panorama.

Should you’re searching for a pockets that mixes usability, privateness, and progress potential, Finest Pockets—and its BEST token—may be value a better look.

—

This rewritten model improves content material move, enhances Website positioning by means of strategic key phrase utilization (e.g., “non-custodial crypto pockets,” “DeFi,” “Finest Pockets options”), and maintains an expert tone appropriate for all audiences.

by uncannyfaith | Sep 9, 2025 | Cryptocurrency news and updates

Bitcoin continues to play a major position in political and financial discussions throughout Germany. Thomas Jarzombek, a member of the CDU and State Secretary for Digital and State Modernization, sees each alternatives and challenges in establishing Germany as a number one crypto and blockchain hub.

Picture supply: © 2025

by uncannyfaith | Jul 11, 2025 | Cryptocurrency news and updates

Title: Cryptocurrency P2P Sentenced to Jail After Receiving Hundreds of thousands in Illicit Transactions

A Brazilian peer-to-peer (P2P) cryptocurrency dealer has been sentenced to jail for working with out correct Know Your Buyer (KYC) procedures. The incident, which sparked a high-profile authorized case, concerned over R$33 million in transactions processed through Pix after a hacker breach inside a fee platform related to a significant gasoline station chain.

The P2P operator, energetic within the cryptocurrency marketplace for 5 years, filed a lawsuit in opposition to a well known monetary establishment in Brazil to problem the felony ruling. Nevertheless, the attraction was denied by the São Paulo Courtroom of Justice, reinforcing the earlier conviction.

Hacker Breach in Cost API Results in Unlawful Transfers

In accordance with court docket paperwork, hackers managed to infiltrate a system linked to the gas provide platform of a outstanding gasoline station community. The breach occurred on August 11, 2024, after unauthorized entry to the fee processing system built-in with a digital pockets and loyalty program identified for providing cashback and reward factors.

The platform’s API, which routes fee information by a third-party processing atmosphere, was exploited to challenge faux instructions for transferring funds. This led the financial institution to unknowingly authorize a number of Pix transfers that amassed over R$33 million, benefiting accounts related to the P2P crypto dealer’s firm.

Following the suspicious exercise, the monetary establishment filed a request to freeze all related financial institution accounts and belongings. The court docket permitted the seizure, focusing on properties and any assets linked to the enterprise and its homeowners.

Lack of KYC Compliance Led to Jail Sentence

Through the investigation, it was revealed that the P2P dealer dealt with transactions for a shopper recognized solely as “James” with out verifying his true identification or gathering obligatory private information. This failure to comply with anti-money laundering protocols considerably contributed to the severity of the conviction.

The sentence, carried out in a semi-open regime, marks a major authorized precedent in Brazil concerning the crypto business’s compliance with monetary rules.

Key Takeaways:

– A P2P crypto dealer in Brazil obtained thousands and thousands through Pix following a system hack linked to a gasoline station’s digital fee service.

– The dealer didn’t carry out correct KYC checks, permitting nameless shoppers to profit from fraudulent transfers.

– Investigating authorities froze belongings and accounts tied to the corporate after discovering over R$33 million transferred illegally.

– A court docket denied the attraction to reverse the choice, confirming the jail sentence in a semi-open regime.

This case highlights the rising significance of regulatory compliance in crypto transactions and the potential authorized penalties of failing to fulfill monetary safety requirements.

by uncannyfaith | Jun 21, 2025 | Cryptocurrency news and updates

Coinbase Secures MiCA License, Expands Crypto Companies Throughout EU

The main US-based cryptocurrency change, Coinbase, has formally obtained approval beneath the Markets in Crypto Property (MiCA) regulatory framework. The license was granted by Luxembourg’s Fee for the Supervision of the Monetary Sector (CSSF), solidifying the platform’s authorized proper to function all through all 27 European Union member states.

With this approval, Coinbase can now present its huge suite of crypto services and products to over 450 million folks throughout the EU. This strategic transfer strengthens the corporate’s place as one of many key gamers within the quickly rising European cryptocurrency market.

“By deciding on Luxembourg, we set up ourselves in a jurisdiction that actually understands the crypto business’s distinctive wants and supplies regulatory readability,” the corporate said following the announcement.

Current licensing efforts have expanded Coinbase’s operational attain, with regulatory approvals already obtained in Germany, France, Eire, Italy, the Netherlands, and Spain. The MiCA license will permit Coinbase to combine these regional efforts right into a unified regulatory framework, streamlining operations and enhancing compliance throughout the European market.

Coinbase joins a rising checklist of cryptocurrency exchanges which have secured the suitable to function in Europe. Notably, different platforms have not too long ago obtained licenses by way of regulatory our bodies in Malta and Austria.

Along with its European growth, Coinbase has demonstrated important development within the monetary world. The corporate debuted on the Nasdaq in April 2021, reaching an preliminary market capitalization surpassing $100 billion. As of the most recent replace, Coinbase’s market valuation stands at $77.4 billion. Moreover, in Could 2025, Coinbase was included within the prestigious S&P 500 index, marking a significant milestone for the crypto business.

This licensing achievement underscores Coinbase’s continued dedication to regulatory compliance and its intention to be a world chief within the cryptocurrency house.

Subscribe for business updates and keep up-to-date on all developments on the earth of digital property and blockchain know-how.