by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

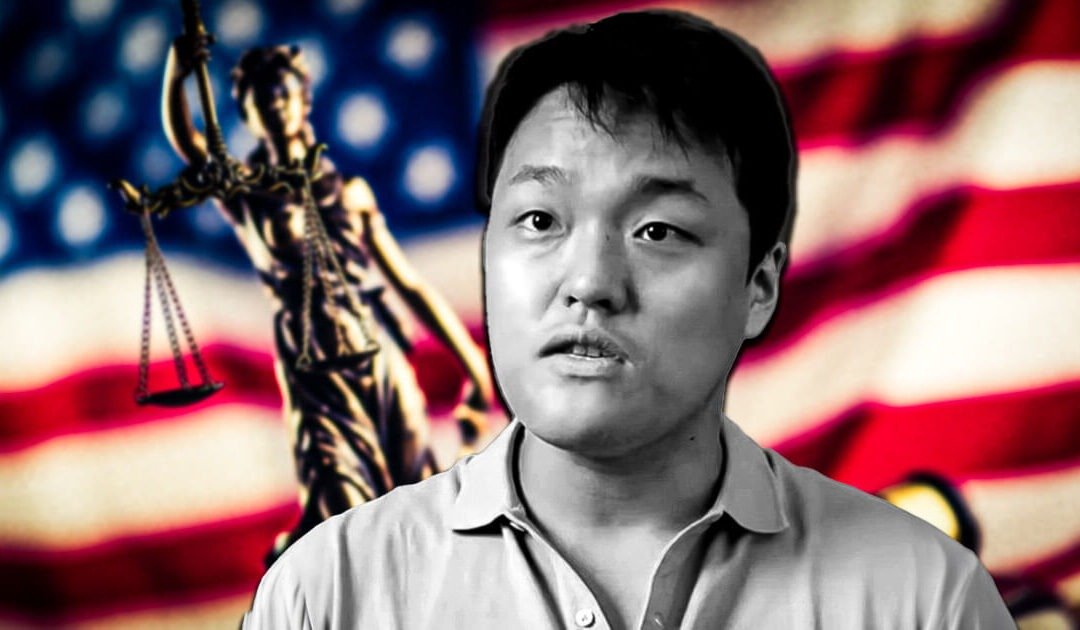

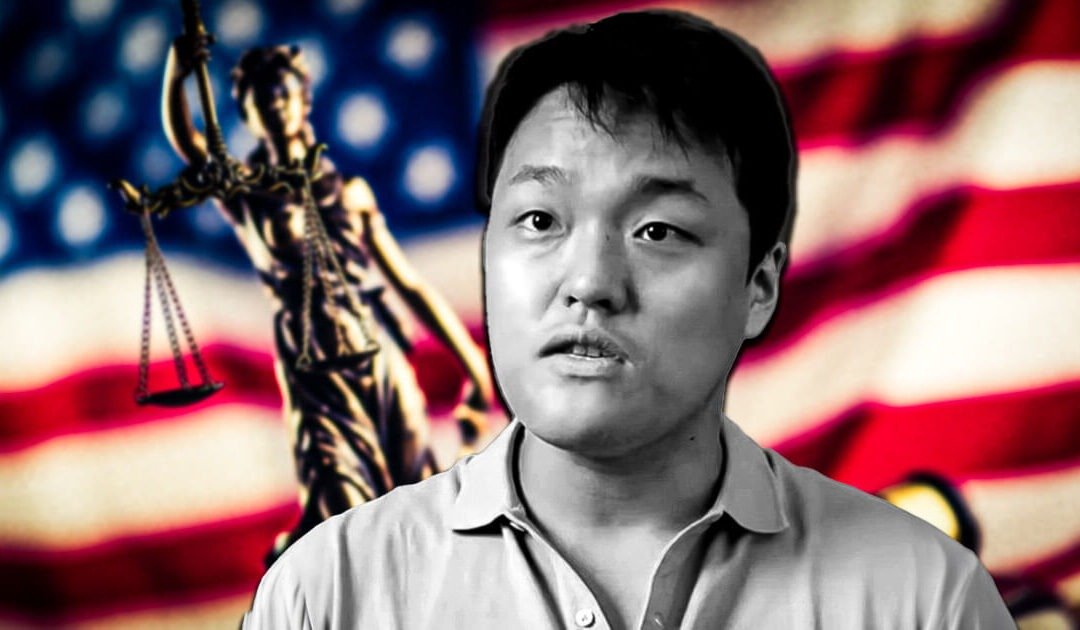

Do Kwon Faces U.S. Court in Crypto Fraud Case Linked to Terra Collapse

On January 2, Terraform Labs co-founder Do Kwon made his first appearance in a U.S. court, where he pleaded not guilty to fraud charges tied to the staggering $40 billion collapse of the TerraUSD (UST) stablecoin. Kwon, who is now at the center of one of the most high-profile crypto scandals, faces nine charges, including wire fraud, securities fraud, and commodities fraud. These charges stem from his alleged involvement in the implosion of Terraform Labs and its tokens, LUNA and UST.

Background: Arrest and Extradition

Do Kwon’s legal troubles began after his arrest in Montenegro in March 2023. He was detained while attempting to leave the country using a fake passport. His arrest sparked an international tug-of-war between U.S. and South Korean authorities, both of whom sought to prosecute him for fraud. While South Korea pushed for extradition due to Kwon’s citizenship, U.S. authorities sought him for his alleged role in misleading investors about Terra’s blockchain capabilities and adoption rates.

In a significant ruling, Montenegro’s Constitutional Court rejected Kwon’s appeal to avoid extradition to the U.S. The country’s Justice Minister subsequently signed the order to extradite him in late December 2023. Kwon was officially handed over to U.S. authorities on December 31 at Podgorica International Airport, where he was flown to face trial in New York.

Fraud Allegations and Legal Consequences

Prosecutors claim that Kwon misled investors, directly contributing to Terra’s dramatic downfall. The Southern District of New York is prosecuting the case, the same office that successfully brought charges against other crypto industry figures in earlier high-profile cases. Alongside his criminal trial, Kwon and Terraform Labs have already been found liable in a civil fraud case initiated by the Securities and Exchange Commission (SEC). The ruling imposed a historic $4.47 billion settlement on the company and Kwon personally, adding more weight to the ongoing legal battles.

Terraform Labs, once a leading name in blockchain innovation, has since filed for bankruptcy.

The Road Ahead

Do Kwon remains in custody without bail as legal proceedings unfold. A court conference is scheduled for January 8, which is expected to set the tone for this highly anticipated crypto fraud trial. If convicted, the Terraform Labs co-founder faces severe consequences, as authorities continue to crack down on financial misconduct in the cryptocurrency space.

This case has once again highlighted the importance of accountability and transparency in the crypto industry, while serving as a stark reminder of the risks involved in speculative digital assets.

This article is designed to provide updates on Do Kwon’s legal journey and its wider implications for the cryptocurrency market.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

BlackRock’s Bitcoin ETF Hits Over $50 Billion in Assets: A Historic Achievement

BlackRock’s iShares Bitcoin Trust (IBIT) has revolutionized the Exchange-Traded Funds (ETFs) market, setting a record-breaking benchmark since its launch in January 2024. In an unprecedented feat, the fund has accumulated more than $50 billion in assets within just 11 months. This substantial growth not only outpaces traditional funds that have been in operation for decades but also marks a transformative moment in the financial industry.

From Skepticism to Widespread Success

BlackRock’s entry into the Bitcoin market represents a pivotal shift in the adoption of cryptocurrency within the global financial ecosystem. With $11 trillion in assets under management, the firm’s embrace of Bitcoin has pushed the largest cryptocurrency past the $100,000 mark for the first time. This historic milestone has not only fueled Bitcoin’s institutional adoption but has also reshaped investor perceptions of digital assets.

The journey to U.S. Bitcoin ETFs has been far from smooth. Early efforts by the Winklevoss brothers back in 2013 faced repeated rejections from regulators, while Grayscale Investments secured a significant legal victory in 2023, paving the way for spot-Bitcoin ETFs. With regulatory approval granted in early 2024, companies like BlackRock, Fidelity, and VanEck launched their Bitcoin ETFs, collectively amassing over $107 billion in assets within the year.

IBIT’s Rapid Growth and Industry Impact

IBIT has emerged as the fastest-growing ETF in history, growing five times quicker than the next closest fund, which took nearly four years to achieve similar asset levels. Already surpassing BlackRock’s gold ETF—historically one of the largest global gold funds—IBIT has firmly established itself as a game-changer in the crypto and ETF markets.

Its influence on market dynamics is profound. IBIT has played a significant role in Bitcoin’s 118% year-to-date price rally. Additionally, it accounts for over 50% of the daily trading volume among Bitcoin ETFs, showcasing its dominance over competitors. Notably, IBIT also introduced Bitcoin ETF options trading, which quickly became a top-performing segment, recording $1.7 billion in daily notional volume.

Significance in the Financial Landscape

The success of IBIT has outpaced over 50 European-focused ETFs that have been operational for over two decades. ETF industry experts highlight that the iShares Bitcoin Trust is setting a precedent for financial innovation. Its unparalleled growth rate and significant contribution to trading activity highlight a growing demand for Bitcoin among investors previously wary of the cryptocurrency.

At the time of reporting, Bitcoin continues to trade close to the $100,000 milestone, solidifying its position as the leading cryptocurrency globally. Its success, largely attributed to platforms like IBIT, is a testament to increasing institutional acceptance and a maturing crypto market.

A Future Shaped by Bitcoin ETFs

BlackRock’s success with IBIT serves as a blueprint for the rapidly evolving cryptocurrency investment landscape. With Bitcoin ETFs gaining traction, the financial world is witnessing a shift as traditional investors and institutions embrace the digital asset revolution. The rise of Bitcoin-focused ETFs is likely to drive further growth in global markets, making cryptocurrency an essential component of diversified investment portfolios.

As the market advances, BlackRock’s early move into the space not only sets the tone for future ETF launches but also underscores the transformative potential of Bitcoin in reshaping global finance. Whether you’re a seasoned investor or new to the world of crypto, this development signals that the era of institutional cryptocurrency investment is here to stay.

Bitcoin prices referenced are subject to market fluctuations.

by uncannyfaith | Jan 2, 2025 | Cryptocurrency news and updates

Women Leading the Bitcoin Movement in 2024: A Global Showcase

In a space historically dominated by men, women from around the world have been making remarkable strides in the Bitcoin ecosystem. From Africa to Latin America, Southeast Asia, and beyond, these women are proving that Bitcoin is shaping lives and economies in profound and transformative ways. Here’s an inspiring list of trailblazing women who have been pivotal in advancing Bitcoin adoption and education in 2024.

Farida Bemba Nabourema — Empowering Bitcoin Adoption in Africa

Farida Nabourema from Togo is a dedicated human rights defender and activist. As the lead organizer of the African Bitcoin Conference, she has connected Bitcoin enthusiasts from across the continent with global developers and advocates. This platform has become a critical space for Bitcoin conversations and education in Africa.

Reyna Chicas — Educating El Salvador

Reyna Chicas, based in El Salvador, was recently promoted to Director of Education for Mi Primer Bitcoin. Two years ago, she attended a conference as a participant, and today, she is at the forefront of Bitcoin education and also serves on the board of the organization. Her work inspires a new wave of Bitcoin users in El Salvador.

Roya Mahboob — A Tech Pioneer for Afghan Women

Roya Mahboob was among Afghanistan’s first female tech CEOs. She founded the Digital Citizen Fund to empower Afghan women through technological literacy. In 2024, she expanded her efforts to schools in Bangladesh, India, Pakistan, and Nepal, opening IT centers for young girls to foster future tech leaders.

Give Rezkitha — Building Bitcoin Communities in Southeast Asia

Give Rezkitha is a key force in promoting Bitcoin in Indonesia. As the Community Master for Southeast Asia, she co-founded the Indonesian Bitcoin Community and played a significant role in organizing the Indonesia Bitcoin Conference. Globally, she represented Southeast Asia at major Bitcoin events like the Oslo Freedom Forum and Bitcoin 2024.

Lorraine Marcel — Revolutionizing Bitcoin Education in Africa

Kenyan innovator Lorraine Marcel founded Bitcoin Dada as a platform for educating African women about Bitcoin. Her efforts earned her the Most Impactful African Bitcoiner of 2024 award. Lorraine’s work is empowering women to become leaders in the Bitcoin space, creating ripple effects throughout the continent.

Isabella Santos — Leading Bitcoin Media in Mexico

Isabella Santos, co-founder of BTC Isla, a Mexican Bitcoin community, and Get Based, a Bitcoin media outlet, is a powerhouse in the Latin American Bitcoin movement. She made waves globally as the host of “Bitcoin Backstage,” offering behind-the-scenes insights from the world’s top Bitcoin conferences.

Noelyne Sumba — Expanding Bitcoin Access in Kenya

Based in Kenya, Noelyne Sumba focused on promoting Bitcoin adoption through mobile wallets compatible with feature phones, enabling financial inclusion in underserved regions. Her translation of "The Bitcoin Standard" into Swahili further strengthened Bitcoin education in East Africa.

Masieh Christ — Supporting Women through Bitcoin

Masieh Christ, with Mauritian and Ugandan roots, advocates for using Bitcoin for peacebuilding. Her organization empowers women in Somalia by teaching them how to use Bitcoin for political fundraising to support female candidates. She also delivered a compelling talk on Bitcoin’s role in counter-terrorism efforts at the Oslo Freedom Forum.

Janet Maingi — Electrifying Rural Africa through Bitcoin

Kenyan entrepreneur Janet Maingi co-founded Gridless Compute, which combines Bitcoin mining with sustainable energy solutions. In 2024, her company not only mined Bitcoin profitably but also brought electricity to rural communities in Africa, showcasing the potential of Bitcoin mining in fostering development.

Mary Imasuen — Amplifying Bitcoin on the Global Stage

Mary Imasuen, of Nigerian and Filipino heritage, serves as the Global Marketing Manager for Fedi. She uses her role to champion Bitcoin education and regularly speaks at industry events. Her passion for Bitcoin-only gaming has also gained her recognition across the Bitcoin and gaming communities.

Honorable Mentions:

- Renata Rodrigues (Brazil) — Head of Marketing at Fedi and a staunch community advocate.

- Lorena Ortiz (Mexico) — Latin America Community Master of Fedi.

- Edith Mpumwire (Uganda) — Community Manager at Bitcoin Dada.

- Sabina Gitau (Kenya) — Co-founder of Tando, promoting sustainability in Bitcoin.

- Isabella Chekovich (Russia) — Advocate for privacy in Bitcoin transactions, part of the Human Rights Foundation’s Freedom team.

- Ella Hough (USA) — Helped launch Cornell University’s independent Bitcoin study program.

Women’s Role in Bitcoin’s Global Evolution

Although this piece highlights a few incredible women, countless others are making a significant impact but remain under-acknowledged. These pioneers, however, share a common determination: to use Bitcoin as a tool for financial freedom, innovation, and empowerment across diverse communities worldwide.

Let’s celebrate their achievements and advocate for greater gender equity in the financial revolution driven by Bitcoin.