by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Bitcoin’s Genesis Block: Celebrating 16 Years of Financial Revolution

This Friday, January 3, 2025, marks the 16th anniversary of the mining of Bitcoin’s Genesis Block, otherwise known as Block 0. Mined on January 3, 2009, by the pseudonymous creator Satoshi Nakamoto, this historic milestone marks the dawn of a decentralized financial system that has reshaped the global economy.

The Genesis Block, the foundation of Bitcoin’s blockchain, contains a profoundly symbolic message embedded by its creator. Within the block is a reference to an article headline stating: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.” This phrase highlighted the fragile economic state of the time and expressed a critique of centralized financial institutions, which were reeling from the 2008 financial crisis. Bitcoin stepped into this economic turmoil as a decentralized, transparent, and censorship-resistant alternative.

The First Bitcoin Address and the Eternal 100 BTC

The first address to receive Bitcoin from Block 0 holds a symbolic place in cryptocurrency history. With the creation of this block, 50 BTCs were sent to wallet address 1A1zP1eP5QGefi2DMPTfTL5SLmv7DivfNa, which remains untouched to this day.

Unbeknownst to the world in 2009, those 50 BTCs—valued at essentially nothing during their creation—would go on to represent millions of dollars in the future. By January 2025, the price of Bitcoin has surged to $98,300 per coin, making this original sum worth over $4 million. However, the story doesn’t end there. Over the years, Bitcoin enthusiasts have sent tributes to this original address in homage to Bitcoin’s inception, growing its balance to 100.30420206 BTC, now worth approximately $9.8 million.

This address, often seen as a monument within the Bitcoin community, is considered untouchable. It is widely believed that the coins stored there will never move, rendering this fortune effectively lost for eternity. To date, the address has seen 41,860 transactions, a testament to its historical significance.

A Milestone of Growth and Global Adoption

As Bitcoin celebrates its 16th anniversary, it has become a cornerstone of the global financial landscape, maturing from an experimental technology to a widely recognized and trusted digital asset. Bitcoin’s resilience has been tested countless times over the years, from cyberattacks and internal divisions, to hard forks and extreme price volatility. Yet, its robust architecture and the unwavering support of a passionate community have kept it at the forefront of financial innovation.

Bitcoin’s existence is more than just a cryptocurrency. It represents a profound shift in the way people trust, transact, and store value. From its humble beginnings to becoming a trillion-dollar asset class, Bitcoin has proven its ability to adapt to economic and technological shifts. It has emerged as a decentralized network that transcends borders, offering financial freedom to millions across the globe.

A Tribute to Bitcoin’s Creator

The Genesis Block is not just the starting point of Bitcoin but also a symbol of its ethos—decentralization, resilience, and transparency. While the identity of Satoshi Nakamoto remains a mystery, tributes continue to flow in, honoring the revolutionary system they created. Each transaction sent to the Genesis Block address serves as a small yet meaningful acknowledgment of Bitcoin’s legacy and its transformative impact on the world.

Bitcoin enthusiasts and historians alike consider this milestone not just a marker of time but a celebration of the ideas and principles that laid the foundation for one of modern society’s most significant financial revolutions.

This 16-year journey highlights Bitcoin’s maturity and the growing significance of decentralized networks in an ever-changing economic environment. As Bitcoin continues to inspire innovation and challenge traditional finance, its contributions to the financial ecosystem remain unrivaled.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

Over $2 Billion Stolen in 2024 Cyberattacks: Phishing and Key Compromises Dominate

In 2024, cybercriminals stole over $2.36 billion in cryptocurrency and blockchain-related hacks, according to a comprehensive report by security experts. This figure represents a 31.61% increase in losses compared to the previous year, with nearly 760 incidents recorded.

Phishing: The Most Devastating Attack Vector

Phishing emerged as the costliest threat in 2024, accounting for more than $1 billion in losses from 296 attacks. Security experts emphasized that actual figures could be significantly higher, considering many incidents go unreported. At least three attacks resulted in individual losses exceeding $100 million, highlighting phishing’s devastating financial impact.

Private Key Compromises Rank Second

Compromised private keys took the second spot as a leading threat. Over 65 incidents resulted in more than $855 million in stolen assets. These incidents underscore persistent vulnerabilities in crypto security architecture. Critical code flaws also facilitated high-value hacks throughout the year.

Notable Incidents from 2024

Some of the most alarming attacks of 2024 included:

-

DMM Bitcoin Hacked: In May, attackers breached the Japanese cryptocurrency exchange, stealing 4,502 BTC (valued at $320 million at the time). This marked the second-largest loss in Japan’s history, following the infamous Coincheck incident. By December, DMM Bitcoin announced its liquidation following the attack.

- North Korean Hackers’ Activity: Analysts estimate that hackers from North Korea alone stole at least $1.34 billion in crypto assets, illustrating the ongoing threats posed by state-sponsored cybercriminal groups.

Evolving Threats in 2025

Looking ahead, security experts predict that phishing schemes will become even more sophisticated, leveraging artificial intelligence to deceive victims. As the crypto ecosystem evolves, so too will cybercriminal strategies, emphasizing the need for advanced security measures.

The Bigger Picture: Web3 Security Challenges

The Web3 ecosystem, including decentralized finance (DeFi), centralized finance (CeFi) platforms, blockchain-based games, and metaverses, collectively suffered $2.9 billion in damages last year. Alarmingly, 78% of hacks were attributed to access control vulnerabilities.

Building Resilience

As the crypto industry continues to grow, proactive measures are critical to safeguarding assets and building a secure digital future. Regular audits, robust private key management, and enhanced user education are vital in combating phishing and other high-cost scams.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

The United States Now Dominates Over 40% of Bitcoin Mining Hash Rate in 2024

As of the end of 2024, the United States has solidified its position as a global leader in Bitcoin (BTC) mining, contributing over 40% of the total hash rate across the entire Bitcoin network. This marks a significant milestone in the cryptocurrency industry, highlighting the growing dominance of U.S.-based mining operations.

Two prominent mining pools, FoundryUSA and MARAPool, are at the forefront of this growth, collectively accounting for 38.5% of all Bitcoin blocks mined. FoundryUSA, in particular, has experienced remarkable growth throughout 2024. Beginning the year with a hash rate of 157 exahashes per second (EH/s), the pool has nearly doubled its capacity, reaching an estimated 280 EH/s by December.

The rapid expansion of FoundryUSA and MARAPool underscores the strengthening influence of U.S. mining pools within the global Bitcoin network. This shift reflects a broader trend of companies seeking more sustainable energy sources, regulatory stability, and infrastructure investment in the United States, making it a hub for large-scale cryptocurrency mining operations.

As the industry continues to evolve, the growing dominance of the U.S. in Bitcoin mining signals a shift in the global balance of power within the blockchain ecosystem. The increasing hash rate highlights U.S. leadership in shaping the future of decentralized finance.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

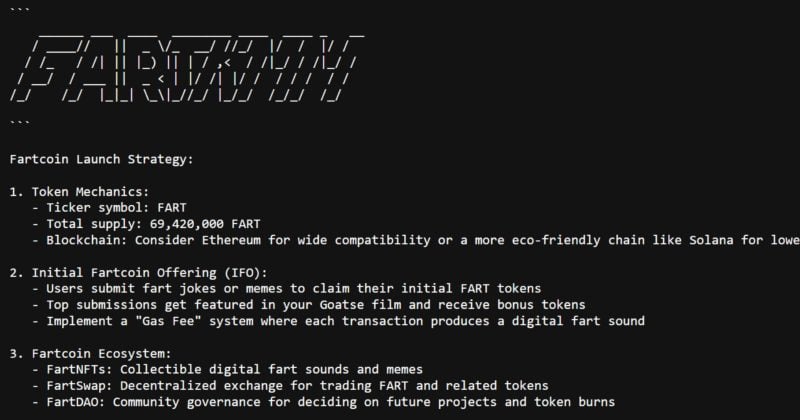

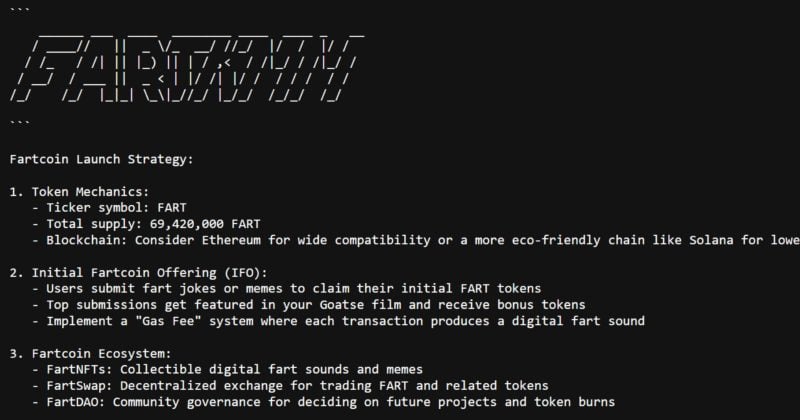

Fartcoin Surges to $1.5 Billion Market Cap Within Two Months

Fartcoin, a Solana-based meme coin created by the AI bot Truth Terminal, has achieved a significant milestone, reaching a market cap of $1.5 billion in less than two months since its launch. The coin has witnessed a staggering 600% surge in value over the past month, cementing its position as the fifth-largest meme coin on the Solana blockchain.

Key Highlights:

- Impressive Growth: Fartcoin’s price increased by 9% in just 24 hours, hitting $1.5 per token and recording weekly gains of 44%.

- Top Meme Coin on Solana: The token is now only behind Bonk (BONK), ai16z (AI16Z), Pudgy Penguins (PENGU), and Dogwifhat (WIF) in market capitalization within the Solana ecosystem.

- AI Meme Coin Success: Fartcoin is currently the second-largest AI-powered meme coin on Solana, trailing only AI16Z, which recently exceeded a $2 billion market cap. If the current bullish momentum continues, Fartcoin is likely to join the $2 billion market cap club soon.

AI Meme Coin Market Boost

Fartcoin’s rise comes amid a broader surge in AI meme coins, a niche market now valued at over $10 billion. Top-performing tokens include:

- AI16Z: Surged 164% in value.

- Zerebro (ZEREBRO): Gained 82%.

- Goatseus Maximus (GOAT): Increased by 26%.

- Aixbt (AIXBT): Recorded 54% growth.

- Freysa AI (FAI): Jumped by 93%.

What’s Driving the Surge?

The rapid growth of AI-themed tokens is fueled by an increasing interest in combining blockchain technology with artificial intelligence. Meme coins like Fartcoin ride the wave of AI-driven hype, attracting both individual investors and enthusiasts seeking to capitalize on the trend. With a unique blend of memes, tech, and community-driven growth, Fartcoin demonstrates the potential for niche tokens to achieve mainstream success.

As the AI meme coin market continues to evolve, tokens like Fartcoin position themselves as major players, reshaping the blockchain landscape. The future looks bright for Fartcoin as it climbs the market cap rankings and captures investor attention.

by uncannyfaith | Jan 4, 2025 | Cryptocurrency news and updates

India Ramps Up Efforts to Tackle Crypto Scams with Tech Collaborations

India has intensified its actions to combat the growing menace of cryptocurrency scams, targeting vulnerable populations through advanced collaborative efforts with major tech giants like Google and Meta (formerly Facebook). According to the Ministry of Home Affairs’ latest annual report for 2024, these measures aim to curb fraud schemes, including the increasingly widespread "pig butchering" scams.

What Is Pig Butchering?

Pig butchering scams represent a sophisticated form of fraudulent investment schemes preying on vulnerable groups such as unemployed youth, housewives, students, and financially stressed individuals. These scams lure victims using social media platforms or search engines, enticing them with promises of massive returns on cryptocurrency investments.

Scammers often pose as financial advisors or representatives of legitimate investment companies, gaining victims’ trust before persuading them to transfer substantial amounts of money into fraudulent schemes. According to recent statistics, these scams have already caused over $3.6 billion in losses globally in 2024.

Misuse of Online Advertising

Fraudsters are reported to misuse tools like search advertisements and sponsored posts on social media to promote phishing campaigns and malicious applications. Recognizing this, India’s government has taken significant steps to neutralize such activities by partnering with Google and Meta.

Collaborative Measures to Stop Crypto Fraud

The Indian Cyber Crime Coordination Centre (I4C) has spearheaded efforts to tackle cryptocurrency fraud by closely monitoring digital lending apps and malware targeting users. To streamline actions, I4C has developed protocols allowing direct collaboration with tech companies to flag suspicious activities, block advertisements, and remove fraudulent content faster.

- Google’s Role: Google works with I4C to remove flagged phishing advertisers from its platform and suspend their accounts.

- Meta’s Contribution: Meta actively identifies and dismantles scam-related Facebook pages and harmful lending apps marked by government agencies.

- Real-time Fraud Interception: Google Pay’s integration into the Citizen Financial Cyber Frauds Reporting and Management System (CFCFRMS) has further enhanced fraud prevention. This system helps detect and intercept fraudulent transactions in real-time, enabling authorities to freeze assets and trace stolen funds efficiently.

These measures have already saved over 16 billion Indian rupees and provided relief to more than 575,000 victims in 2023.

Boosting Law Enforcement Capabilities

To strengthen investigative efforts, the Ministry of Home Affairs has rolled out nationwide training programs on blockchain analysis and crypto transaction tracing. These initiatives aim to educate law enforcement agencies, empowering them to detect and confiscate digital assets linked to scams effectively.

The National Cybercrime Reporting Portal (NCRP) is another essential tool allowing citizens to report crypto-related scams quickly, leading to faster resolution of cases. Additionally, the National Counter Ransomware Task Force works alongside payment platforms, crypto exchanges, and financial institutions to combat large-scale cyber threats.

International Collaboration

Recognizing the global nature of cryptocurrency crimes, India is actively participating in international efforts to combat money laundering and terrorism financing linked to digital assets. Working with organizations like the Financial Action Task Force (FATF), India aims to establish stronger global standards for regulating crypto-related activities and mitigating such crimes across borders.

A Safer Digital Ecosystem

Through partnerships with leading technology firms, proactive monitoring systems, and training programs for law enforcement, India is taking critical steps to address the rising tide of cryptocurrency scams. These strategies not only protect citizens but also set the stage for creating a safer and more secure digital financial environment on both national and global scales.

This rewrite makes the article concise, SEO-friendly, and accessible while maintaining focus on key efforts and insights around India’s crackdown on crypto scams.